Crypto Exchange Safety: How to Pick a Secure Platform and Avoid Scams

When you trade crypto, your crypto exchange safety, the protection of your funds and personal data on a platform that buys, sells, or stores digital assets. Also known as crypto platform security, it’s not just about strong passwords—it’s about whether the exchange has real oversight, audits, and a track record of protecting users. Too many people lose everything because they picked a platform that looked shiny but had no real security behind it.

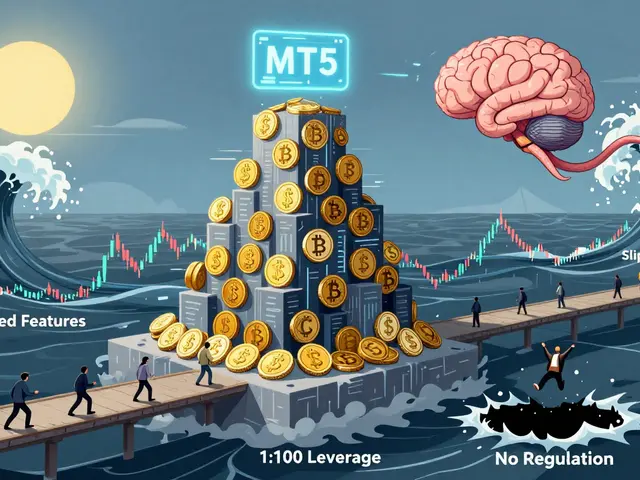

There are two kinds of exchanges: regulated ones like Coinbase, a licensed U.S.-based platform that follows KYC and anti-money laundering rules, and unregulated ones that promise anonymity but vanish overnight. The no-KYC exchange, a platform that doesn’t require identity verification, often used for privacy but frequently targeted by fraudsters might feel tempting, but over 15 major ones have been shut down since 2022. The crypto exchange scams, fraudulent platforms designed to steal funds through fake interfaces, phishing, or outright theft don’t always look fake—they often copy real sites, use fake reviews, and promise impossible returns. You can’t trust a platform just because it has a sleek website or a Twitter account with 50K followers.

Behind every safe exchange is something most users never see: smart contract auditing, an independent security review of the code that runs the exchange’s trading and wallet systems. Firms like CertiK and OpenZeppelin check for hidden flaws that hackers can exploit. If an exchange doesn’t publish audit reports, don’t trust it. Even if it’s labeled "decentralized," if the team is anonymous and the code hasn’t been reviewed, your money is at risk. The crypto exchange safety you think you’re getting might be a mirage.

Look at the posts below. You’ll find real cases—like BITEXBOOK and Horizon Dex—where platforms looked legit but had zero transparency. You’ll see how users in Bangladesh, North Macedonia, and Cuba still trade despite bans, not because they’re reckless, but because they know which platforms won’t freeze their funds. You’ll learn how fake airdrops trick people into handing over private keys, and why the $150 million frozen in the Philippines happened in the first place. This isn’t theory. These are real losses, and the patterns are clear. The right exchange doesn’t shout—it protects. And you don’t need to be an expert to spot the difference.

ko.one Crypto Exchange Review: What You Need to Know Before Trading

ko.one crypto exchange has no verified presence, regulatory licenses, or security audits. This review exposes it as a likely scam and lists trusted alternatives for safe crypto trading.