Crypto Volatility: What It Is, Why It Matters, and How to Navigate It

When you hear crypto volatility, the rapid and often unpredictable price changes in digital assets like Bitcoin or Ethereum. Also known as market fluctuation, it's what turns a $10,000 investment into $15,000 in a week—or drops it to $7,000 by Friday. This isn’t just noise. It’s the heartbeat of crypto markets, fueled by everything from regulatory news to meme trends and whale movements.

Behind every sharp price jump or crash lies market depth, how much buying and selling pressure exists at each price level. A shallow order book means even a small trade can swing prices—this is why low-cap tokens spike or crash in minutes. Meanwhile, liquidity analysis, the process of measuring how easily assets can be bought or sold without changing their price tells you if a market is safe to trade in. High liquidity? You can enter and exit smoothly. Low liquidity? You’re at the mercy of whoever controls the big wallets.

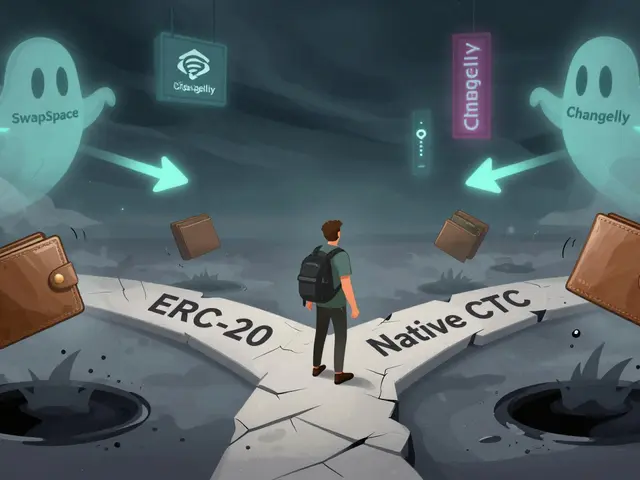

crypto trading, the act of buying and selling digital assets on exchanges isn’t about guessing the next big move—it’s about reading the water. The most successful traders don’t chase pumps. They watch order books, track volume spikes, and avoid tokens with fake trading activity. That’s why posts here cover everything from fake airdrops pretending to be legitimate to exchanges with zero liquidity and hidden risks. You’ll find real examples: how $150 million in crypto got frozen in the Philippines because exchanges had no real buyers, why Horizon Dex has no trading function at all, and how BSC AMP trades at $0 because no one believes it’s real.

Understanding blockchain liquidity, how much actual buying power exists across decentralized and centralized platforms helps you avoid traps. A token might look cheap, but if there’s no depth behind it, you’re holding a digital ghost. That’s why we break down projects like ElonDoge and Moonft—not to mock them, but to show you what empty markets really look like. Meanwhile, platforms like PancakeSwap on Linea or Uniswap give you real liquidity, low fees, and transparent order flow. The difference? One lets you trade. The other lets you lose money.

What you’ll find below isn’t a list of random crypto stories. It’s a practical field guide to spotting volatility traps, understanding what moves markets, and learning how to trade smarter—not harder. From India’s underground crypto use to Cuba’s Bitcoin survival economy, these posts show how real people navigate chaos. You’ll see why no-KYC exchanges are being shut down, how fake airdrops exploit volatility, and why security audits matter more than hype. This isn’t theory. It’s what happens when volatility meets reality.

Stablecoins: How They Solve Crypto Volatility

Stablecoins solve crypto's biggest problem-volatility-by pegging their value to stable assets like the U.S. dollar. They enable fast, low-cost digital payments and are becoming essential for global finance.