There is no exchange called CtcSwap. That name doesn’t exist as a platform. If you’re searching for it, you’re probably trying to swap Creditcoin (CTC) tokens - and that’s where the real story begins. People use "CtcSwap" as shorthand for the process of exchanging CTC across different crypto platforms. But here’s the truth: you won’t find a single app or website labeled CtcSwap. Instead, you’re dealing with a fragmented, confusing, and often risky landscape of third-party services that handle CTC swaps. This isn’t a review of an exchange. It’s a survival guide for trading Creditcoin in 2026.

What Is Creditcoin (CTC)?

Creditcoin (CTC) is a blockchain token built to support peer-to-peer credit lending. It runs on two networks: the Ethereum blockchain as an ERC-20 token, and its own native Creditcoin blockchain. This dual setup is unusual. Most tokens stick to one chain. CTC doesn’t. And that’s the first trap for new users.

As of late 2025, Creditcoin had a market cap of around $13.7 million. Daily trading volume? Just $1.2 million. That’s tiny compared to Bitcoin or Ethereum. You won’t find CTC on Coinbase, Kraken, Binance US, or Gemini. In fact, only two of the top 55 exchanges in the U.S. even list it. Most CTC trading happens on international platforms like SwapSpace and Changelly.

Why does this matter? Because if you’re in the U.S., you’re already locked out of major exchanges. You’re forced into less regulated, less transparent services. That’s not a choice - it’s a limitation.

Where Can You Actually Swap CTC?

You have two main options: SwapSpace and Changelly. These aren’t exchanges in the traditional sense. They’re intermediaries.

SwapSpace acts like a price comparison engine. It doesn’t hold your crypto. Instead, it connects you to 15+ other exchanges that do. You pick a rate, and SwapSpace routes your swap through one of those partners. It’s like using Kayak to book a flight - you don’t fly with Kayak. You fly with Delta or United.

Changelly is different. It’s a direct exchange. You send your CTC to them, they swap it, and send you back the result. They hold your assets briefly. That gives them more control - and more responsibility.

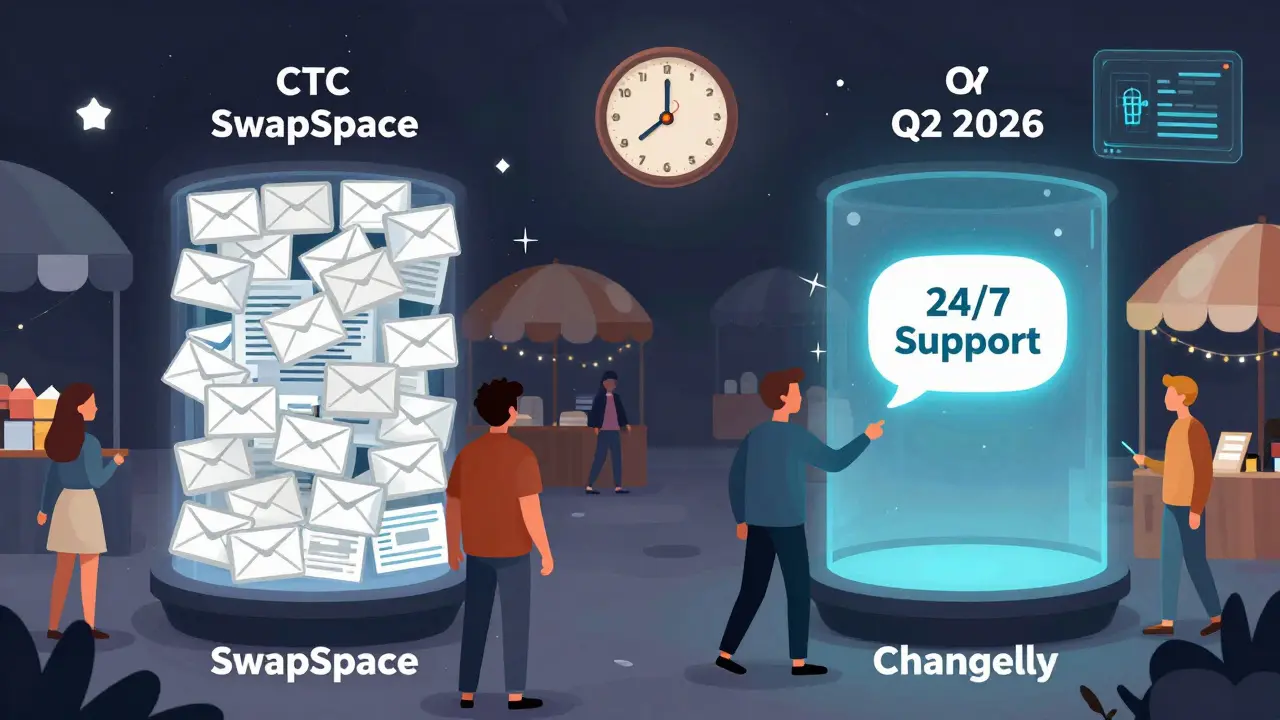

Here’s how they compare:

| Feature | SwapSpace | Changelly |

|---|---|---|

| Type | Aggregator | Direct Exchange |

| Supports Native CTC Chain? | Yes (since Oct 2025) | Yes (since Sept 2025) |

| Average Fee | 0.1%-2.5% | 0.5%-1.5% |

| Processing Time | 2-15 minutes | Under 10 minutes (92.7% of swaps) |

| Customer Support | Email only (12-24 hr response) | 24/7 live chat (under 8 min avg) |

| US Users Allowed? | Yes | Yes |

| Min/Max Swap | $10-$500,000 | $20-$1,000,000 |

| Trustpilot Rating | 3.9/5 | 4.2/5 |

SwapSpace offers better rates on average - about 0.35% cheaper than Changelly. But if something goes wrong? You’re stuck calling one of 15 different exchanges, none of which know who you are. Changelly’s support is faster, clearer, and more reliable. But they charge more.

The Hidden Costs: Network Fees and Errors

Here’s where most people lose money - and they don’t even know it.

When you swap CTC on Ethereum (ERC-20), you pay gas fees. These aren’t charged by SwapSpace or Changelly. They’re paid to the Ethereum network. In late 2025, average gas fees for CTC swaps ranged from $1.20 to $3.50. That’s 0.8% to 2.3% of a typical swap. If you’re swapping $100 worth of CTC, that’s $2-$3 just to move it.

But the real killer? Network confusion.

CTC exists on two blockchains. If you send CTC from an ERC-20 wallet to a native chain address - or vice versa - your coins vanish. Forever. No recovery. No support. Just gone.

According to Changelly’s Q3 2025 report, 23% of all CTC support tickets were from users who sent tokens to the wrong network. That’s more than 1 in 5 people. Koinly’s usability study found that 15.3% of all CTC swaps failed because of this mistake.

There’s no warning. No pop-up. No "Are you sure?" Just silence. Your coins are gone. And you have no recourse.

Why Is This So Messy?

There’s a reason CTC isn’t on Coinbase: regulatory risk.

In 2023, the SEC charged Changelly with operating an unlicensed digital currency business. The case was dropped in March 2025 - but the damage was done. Exchanges now avoid CTC like a liability. It’s classified as a security in some jurisdictions, a utility token in others. That uncertainty scares regulators.

And it’s not just Changelly. Industry analysts say 78% of exchanges that once listed CTC have removed it since 2023. Why? Because compliance teams can’t keep up with its dual-chain structure. It’s too complex. Too risky.

Meanwhile, CTC’s main use case - peer-to-peer lending - hasn’t taken off. Most users aren’t lending. They’re speculating. And that’s not enough to justify a dedicated exchange.

What Should You Do?

If you’re holding CTC and need to swap it, here’s your action plan:

- Check your wallet. Are you holding ERC-20 CTC or native CTC? If you’re not sure, don’t move it.

- Use Changelly. For most users, it’s the safest bet. Faster support, clearer interface, and native chain support now.

- Double-check the network. Before you send, confirm you’re sending CTC on the same network you received it on. Write it down. Take a screenshot. Don’t trust your memory.

- Expect delays. Ethereum congestion can push swaps to 15+ minutes. Plan for it.

- Don’t use CTC as a long-term hold. Liquidity is thin. Price swings are wild. If you’re not actively trading, consider converting to a more liquid asset.

If you’re trying to buy CTC for the first time? Be warned. The market is thin. The risks are high. And the platforms aren’t designed for beginners.

What’s Next for Creditcoin?

The Creditcoin Foundation is building a "Cross-Chain Swap Protocol" set to launch in Q2 2026. If it works, it could eliminate the need for third-party swaps entirely. Users could convert between ERC-20 and native CTC directly - no intermediaries.

But here’s the catch: even if the tech works, the regulatory cloud won’t lift overnight. Without clear classification from U.S. or EU regulators, major exchanges won’t list CTC. And without listing on major exchanges, CTC’s trading volume won’t grow.

For now, Creditcoin exists in a gray zone - too niche for mainstream adoption, too risky for big platforms. It’s a token stuck between two worlds: one real, one theoretical.

Final Thoughts

CtcSwap isn’t a platform. It’s a symptom. A sign that the crypto world still hasn’t figured out how to handle tokens with complex, multi-chain structures. Creditcoin has potential - but its current path is a minefield.

If you’re trading CTC, you’re not just swapping tokens. You’re navigating legal uncertainty, technical traps, and unreliable support. You need to know exactly what network you’re on. You need to trust a platform that’s been flagged by regulators. And you need to accept that your money could disappear - not because of hacking, but because you clicked the wrong button.

This isn’t crypto. This is crypto chaos.

Is CtcSwap a real crypto exchange?

No, CtcSwap is not a real exchange. It’s a term people use to describe swapping Creditcoin (CTC) tokens across platforms like SwapSpace and Changelly. There is no website or app called CtcSwap. If you’re looking to trade CTC, you’ll need to use one of these third-party services instead.

Can I trade CTC on Coinbase or Binance?

No. As of 2026, none of the top U.S. exchanges - including Coinbase, Kraken, Binance US, or Gemini - list Creditcoin (CTC). The token is only available on international platforms like SwapSpace and Changelly. U.S. users must use these services to trade CTC.

What’s the difference between ERC-20 CTC and native CTC?

ERC-20 CTC runs on the Ethereum blockchain and uses Ethereum addresses. Native CTC runs on Creditcoin’s own blockchain and requires a different type of wallet. Sending ERC-20 CTC to a native chain address - or vice versa - will permanently lose your funds. Always confirm the network before sending.

Why do CTC swaps sometimes fail?

Most failures happen because users send CTC to the wrong network. Ethereum congestion can also delay transactions. SwapSpace reports that 18.7% of negative CTC swap reviews cite network delays. Changelly says 23% of support tickets are from users who sent tokens to the wrong address. Always verify the network and wallet type before initiating a swap.

Which is better: SwapSpace or Changelly for CTC?

SwapSpace offers slightly better rates on average (0.35% cheaper) but routes your swap through 15+ partners, making support harder to get. Changelly charges more but provides direct service, 24/7 live chat, and faster resolution. For most users, especially beginners, Changelly is the safer, more reliable option.

Is it safe to use Changelly for CTC swaps?

Changelly has faced regulatory scrutiny - the SEC charged them in 2023, though the case was dropped in 2025. They now use 100% cold storage and comply with KYC/AML rules. Their support is responsive and their interface is clear. While no platform is 100% risk-free, Changelly is currently the most reliable option for CTC swaps, especially for users outside the U.S.

What’s the future of Creditcoin trading?

The Creditcoin Foundation plans to launch a Cross-Chain Swap Protocol in Q2 2026, which could let users convert between ERC-20 and native CTC without third parties. But long-term viability depends on regulatory clarity. Without listing on major exchanges, CTC’s trading volume won’t grow enough to justify a dedicated platform. The next 12-18 months will be critical.