P2P Crypto: How Peer-to-Peer Trading Works and Why It’s Growing Fast

When you trade P2P crypto, a method of buying and selling cryptocurrency directly between individuals without an intermediary exchange. Also known as peer-to-peer trading, it’s how millions in India, Cuba, and Nigeria bypass blocked banks, high fees, and strict KYC rules to get access to Bitcoin and stablecoins. This isn’t just a workaround—it’s a shift in how money moves. People use apps like LocalBitcoins, Paxful, or built-in P2P features on Binance to send cash via bank transfer, UPI, or even gift cards, and get crypto in minutes. No middleman. No waiting days for a withdrawal. Just direct, trust-based trades.

What makes P2P crypto powerful is who uses it. In countries where banks shut out crypto users—like Bangladesh, where trading can lead to legal trouble, or the Philippines, where $150 million in assets got frozen—P2P is the only way in. It’s not just for techies. Students in Mumbai pay rent in USDT. Cuban families get remittances through Ethereum. Small shop owners in Turkey accept Bitcoin via P2P because the government banned credit card payments but didn’t stop direct trades. These aren’t outliers. They’re the new normal for people who need financial freedom.

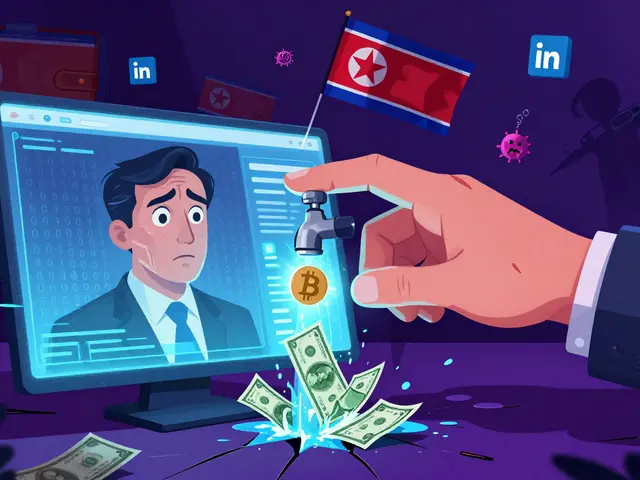

But P2P crypto isn’t risk-free. Because there’s no central platform holding your funds, scams happen. Fake buyers, chargebacks, and fake payment screenshots are common. That’s why trusted platforms build in escrow systems—your crypto stays locked until the seller confirms cash arrived. And while P2P avoids KYC, that’s also why regulators are cracking down. Platforms like KuCoin and BitMex got shut down for letting users trade without identity checks. Now, even P2P apps are being forced to collect IDs in some regions. The tension is clear: people want control, but governments want oversight.

Behind every P2P trade is a deeper story about access. It’s not about speculation. It’s about survival. It’s about sending money home when Western Union won’t work. It’s about buying food when your local currency is collapsing. That’s why P2P crypto isn’t fading—it’s spreading. And as more people learn how to trade safely, the tools are getting better. Escrow systems, dispute resolution, and user ratings are making it harder for bad actors to win. You don’t need to be an expert to start. Just know the risks, stick to verified platforms, and never send money before you get the crypto.

Below, you’ll find real stories from places where P2P crypto isn’t optional—it’s essential. From India’s underground crypto economy to Cuba’s regulated digital cash system, these posts show how people are using peer-to-peer trading to take back control of their money.

Underground Crypto Trading in North Macedonia: How People Bypass the Ban

Despite an official ban since 2017, crypto trading thrives underground in North Macedonia through P2P platforms and international brokers. Here’s how people trade safely-and why regulation is coming.