Transaction Verification Simulator

How Lazarus Group Manipulates Transactions

The Lazarus Group doesn't hack private keys. They alter what you see on screen. This simulator shows how a transaction can appear legitimate while secretly sending funds to a different destination.

Your Transaction Appears Here

Transaction Type: Withdrawal

Amount: $2,000

Destination Address: 0x1234...5678

Transaction Status: Approved

How to Protect Yourself

Never trust what you see on screen alone. The Bybit heist happened because the interface showed one destination while sending funds to another.

- Always check the exact destination address on a blockchain explorer before confirming

- Use a separate device to verify transaction details

- For large transactions, require multiple verification steps

- Never approve transactions from unsolicited messages or links

On February 21, 2025, a single digital transaction erased $1.5 billion from Bybit-one of the world’s largest cryptocurrency exchanges. No physical vault was broken into. No guard was bribed. The theft happened through a fake button click, a manipulated user interface, and a CEO who thought he was approving a routine transfer. This wasn’t a glitch. It wasn’t luck. It was the Lazarus Group, North Korea’s most dangerous cyber unit, pulling off the biggest cryptocurrency heist in history.

How Lazarus Group Turns Crypto Exchanges Into ATMs

The Lazarus Group doesn’t break into systems the way you’d expect. They don’t brute-force passwords or flood networks with malware. They wait. They observe. They build trust. Then they strike where security is weakest: the human mind. Their attack on Bybit followed a four-step playbook that’s now the gold standard for state-sponsored crypto theft:- Spear phishing: Hackers sent fake job offers and urgent security alerts to Bybit employees. One clicked a link. One opened a PDF. That was all it took.

- Frontend manipulation: They didn’t touch the cold wallet’s private keys. Instead, they injected malicious code into the Safe Wallet interface-the very tool employees used to approve transactions. When CEO Ben Zhou signed off on what looked like a $2 million transfer, the system quietly rerouted 401,000 ETH ($1.46 billion) to a Lazarus-controlled wallet.

- Chain-hopping: Stolen Ethereum was swapped for Bitcoin and Dai on decentralized exchanges. This isn’t just obfuscation-it’s a deliberate strategy to break the trail across blockchains.

- Waiting game: They didn’t cash out immediately. They let the heat die down. Months later, funds began moving through mixers, tumblers, and obscure DeFi protocols, making recovery nearly impossible.

Why Multi-Signature Wallets Failed

Most exchanges brag about their multi-signature wallets-requiring 3 or 5 people to approve a withdrawal. It sounds bulletproof. But Lazarus doesn’t attack the keys. They attack the interface. Think of it like this: Your bank requires two signatures to transfer money. But what if the online portal you use to request the transfer was secretly rewritten to show one amount, while sending another? That’s exactly what happened at Bybit. The interface lied. The signers trusted it. The system had no way to detect the fraud because the transaction looked legitimate from the backend. This exposes a blind spot in crypto security: we’ve optimized for cryptographic integrity, but ignored human-interface integrity. No amount of hardware security modules or air-gapped servers matters if the screen you’re looking at is a lie.The New Social Engineering Playbook

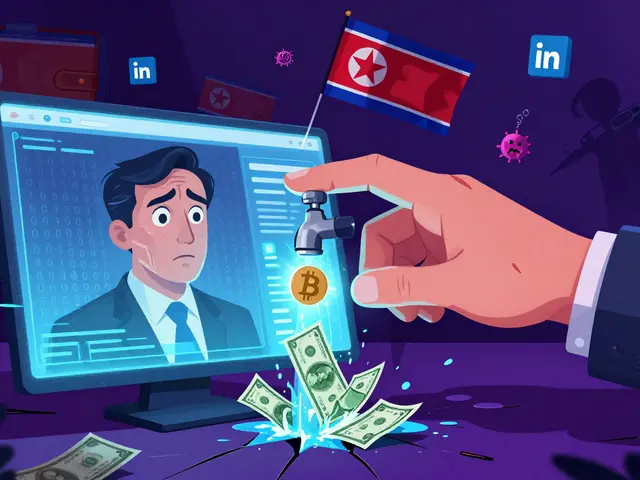

Lazarus doesn’t rely on spam emails anymore. They’ve moved to LinkedIn. Their TraderTraitor subgroup now targets security researchers and crypto engineers with fake job offers, conference invites, and even fake research collaborations. They build relationships over weeks. They share technical papers. They ask for feedback on open-source tools. Then-when trust is established-they send a "critical update" for a wallet app or trading bot. That update? It’s a remote access trojan called MANUSCRYPT. Once installed, it harvests wallet keys, clipboard data, and even screenshots of authentication screens. This is not random hacking. It’s intelligence gathering disguised as networking. It’s the same tactic used by Russian and Chinese espionage units-but applied with terrifying precision to the crypto world.

The Billions in Motion: A Timeline of Heists

Between June and September 2025 alone, Lazarus pulled off five confirmed attacks totaling over $280 million:- Atomic Wallet: $100 million stolen in June

- CoinsPaid: $37.3 million in July

- Alphapo: $60 million in August

- Stake.com: $41 million in August

- CoinEx: $54 million suspected in September

Why Bitcoin Is Their Favorite Target

You’d think Ethereum, with its smart contracts and DeFi integrations, would be the prime target. But Lazarus prefers Bitcoin. Why?- High liquidity: Bitcoin trades on every exchange, globally, 24/7. No delays.

- Low traceability: Once moved through mixers like Wasabi or Samourai, Bitcoin becomes nearly impossible to track.

- Global acceptance: Unlike altcoins, Bitcoin is recognized as real value-even by underground markets and sanctioned entities.

- Fixed supply: No inflation risk. $1 billion in Bitcoin in 2025 is still $1 billion in 2026.

What Exchanges Are Doing-And Why It’s Not Enough

After the Bybit heist, several exchanges upgraded their security. Some added biometric approvals. Others required manual phone calls for large transfers. Bybit itself recovered $40 million and restored all user funds. But here’s the problem: these are band-aids. No exchange has fixed the core issue: the user interface is the attack surface. If a hacker can change what you see on your screen, no amount of two-factor authentication or hardware wallets will save you. Security teams now recommend:- Real-time transaction verification via separate devices

- Blockchain-based audit trails that log every UI change

- Employee training that simulates Lazarus-style LinkedIn phishing

- Automated alerts for any transaction that changes destination addresses mid-process

The Bigger Threat: A Nation-State With No Fear of Consequences

Unlike criminal gangs, Lazarus doesn’t care about getting caught. North Korea has no extradition treaties. No Interpol cooperation. No financial system to freeze. They operate from Pyongyang with total impunity. Their mission isn’t profit. It’s survival. Every dollar stolen funds their nuclear program. Every Bitcoin heist buys missile fuel. Every Ethereum stolen pays for a scientist’s salary. The Center for Strategic and International Studies calls this “cyber-enabled state terrorism.” The U.S. Treasury has sanctioned over 100 Lazarus-linked wallets-but the group simply creates new ones. They’ve moved to non-KYC DeFi protocols, privacy coins, and even NFT marketplaces to launder funds. And they’re getting faster. In 2023, they pulled off one major heist every 6 months. In 2025, it’s one every 20 days.What You Can Do-Even If You’re Not an Exchange

You might think this doesn’t affect you. But if you hold crypto, you’re part of the system they’re breaking. Here’s what actually works:- Never click links from LinkedIn DMs, even from “security experts” or “researchers.”

- Use a hardware wallet for anything over $1,000. Even if your computer is compromised, your private keys stay offline.

- Enable transaction confirmations on a separate device-like your phone or a dedicated tablet.

- Check transaction details on a blockchain explorer before approving. Look at the exact destination address. Don’t trust what your wallet app shows.

- Use a dedicated, air-gapped computer for managing large holdings. No internet. No updates. No apps.

The Future: Can Crypto Survive?

Lazarus Group isn’t going away. As sanctions tighten, their heists will grow more frequent and more brazen. By 2026, experts predict they’ll target stablecoin issuers, DeFi protocols, and even central bank digital currency (CBDC) pilot programs. The crypto industry is at a crossroads. Either we rebuild security from the ground up-treating the user interface as a weaponized attack surface-or we accept that billions will keep vanishing into North Korean missile silos. There’s no magic fix. No blockchain upgrade will stop a lie on a screen. The only defense left is awareness, skepticism, and a refusal to trust what looks easy. Because in the end, the most dangerous thing about Lazarus isn’t their code. It’s that they know you’ll click ‘Confirm’ anyway.Is the Lazarus Group still active in 2025?

Yes. As of December 2025, Lazarus Group remains the most active state-sponsored cybercriminal organization targeting cryptocurrency. They executed at least five major heists between June and September 2025 alone, including the $1.5 billion Bybit breach in February. Their operational tempo has increased dramatically, with attacks now occurring every 20 days on average.

How did Lazarus steal $1.5 billion from Bybit?

They didn’t hack the cold wallet directly. Instead, they infected the Safe Wallet frontend interface with malicious code. When Bybit’s CEO approved a transaction, the interface showed one destination address but sent funds to a Lazarus-controlled wallet. The multi-signature system approved the transaction because it looked legitimate-no cryptographic keys were compromised, only the user interface was manipulated.

Why do they prefer Bitcoin over other cryptocurrencies?

Bitcoin offers the highest liquidity, global acceptance, and strongest resistance to devaluation. Unlike altcoins, Bitcoin is recognized as real value even in sanctioned markets. It’s easier to move, convert, and spend without raising red flags. Lazarus converts stolen Ethereum and other tokens into Bitcoin as soon as possible for this reason.

Can multi-signature wallets protect against Lazarus attacks?

Not if the interface is compromised. Multi-signature wallets are designed to prevent single-point failures-but they assume the user interface is trustworthy. Lazarus bypasses this by altering what users see on-screen. Even with 5-of-7 signatures required, if every signer approves a transaction that looks correct, the system will execute it. The flaw isn’t in the crypto-it’s in the human trust of the display.

What’s the best way to protect personal crypto holdings from Lazarus-style attacks?

Use a hardware wallet like Ledger or Trezor for any significant holdings. Never click links from unsolicited LinkedIn messages or emails, even if they look professional. Always verify transaction details on a blockchain explorer like Etherscan or Blockchain.com before confirming. For large amounts, use a separate, air-gapped device with no internet connection. Your biggest vulnerability isn’t your wallet-it’s your trust in what you see on your screen.

Has any government successfully tracked and punished Lazarus Group members?

No. North Korea has no extradition treaties with Western nations, and Lazarus operates entirely from within its borders. While the U.S. Treasury has sanctioned over 100 cryptocurrency addresses linked to the group, no individual has been arrested or prosecuted. The group’s anonymity, state backing, and use of decentralized finance make traditional law enforcement nearly useless.

Chevy Guy

December 16, 2025 AT 15:20And the solution is... don't click links?

Wow. Groundbreaking. I'll add that to my list of life hacks next to 'don't stick forks in outlets'.

Meanwhile, North Korea's building nukes with my ETH. Cool.

Kelsey Stephens

December 17, 2025 AT 16:59Sue Bumgarner

December 18, 2025 AT 22:09Kayla Murphy

December 20, 2025 AT 19:48Florence Maail

December 21, 2025 AT 23:29Meanwhile, your exchange is still asking you to 'verify your identity with a selfie' while their UI is being rewritten by hackers in Pyongyang.

Who's really in charge here? The blockchain? Or the guy who coded the button that says 'Confirm' but actually says 'Send All'? 😂

Don't trust apps. Don't trust 'security updates'. Don't trust LinkedIn. Trust nothing. Especially not your own brain.

Abby Daguindal

December 23, 2025 AT 07:30SeTSUnA Kevin

December 23, 2025 AT 12:30Madhavi Shyam

December 25, 2025 AT 01:50Chevy Guy

December 26, 2025 AT 01:27Meanwhile, I'm still waiting for the day someone builds a wallet that doesn't look like it was designed by a sleep-deprived intern at a crypto bro convention.