Can a business in India legally accept Bitcoin, Ethereum, or any other cryptocurrency as payment for goods or services? The short answer is no. But the full picture is far more complex than a simple yes or no. If you're running a business in India and thinking about accepting crypto, you need to understand what’s allowed, what’s not, and what risks you’re stepping into.

What’s Actually Legal?

Cryptocurrency isn’t banned in India. You can buy it, sell it, hold it, and trade it. The Supreme Court lifted the Reserve Bank of India’s banking ban on crypto in 2020, and since then, millions of Indians have invested in digital assets. But there’s a critical difference between owning crypto and using it as payment. The government doesn’t treat cryptocurrency as legal tender. That means it’s not the same as rupees. You can’t pay your electricity bill, rent, or supermarket bill with Bitcoin - not legally. The Income Tax Department and the Finance Ministry have made this clear: crypto is a Virtual Digital Asset (VDA), not money. So what can businesses legally do? You can run a crypto exchange, offer trading services, provide blockchain development, or advise on crypto investments. Many Indian startups operate in these spaces. But if you’re a restaurant, a retail store, or a service provider trying to accept crypto as payment for your core product? That’s where you cross the line.Why Can’t You Accept Crypto as Payment?

The reason is simple: legal recognition. Only the Indian rupee is recognized as legal tender under the Reserve Bank of India Act. Even though crypto transactions are allowed, the government has repeatedly warned against using digital assets for everyday payments. In 2023, the Finance Ministry released a statement clarifying that while individuals can trade crypto, businesses must not treat it as a currency for transactions. The RBI has also repeatedly stated that crypto poses risks to financial stability and consumer protection. Their stance is clear: if you want to accept payments, use rupees - or the upcoming digital rupee (CBDC), which the central bank is actively testing. This isn’t just about rules - it’s about practicality. If you accept Bitcoin and the price drops 15% in a day, who absorbs the loss? The business? The customer? The government doesn’t want to deal with that mess. So instead of allowing crypto payments, they’ve created a strict tax and compliance system around crypto as an asset class.How Crypto Is Taxed (And What It Means for Businesses)

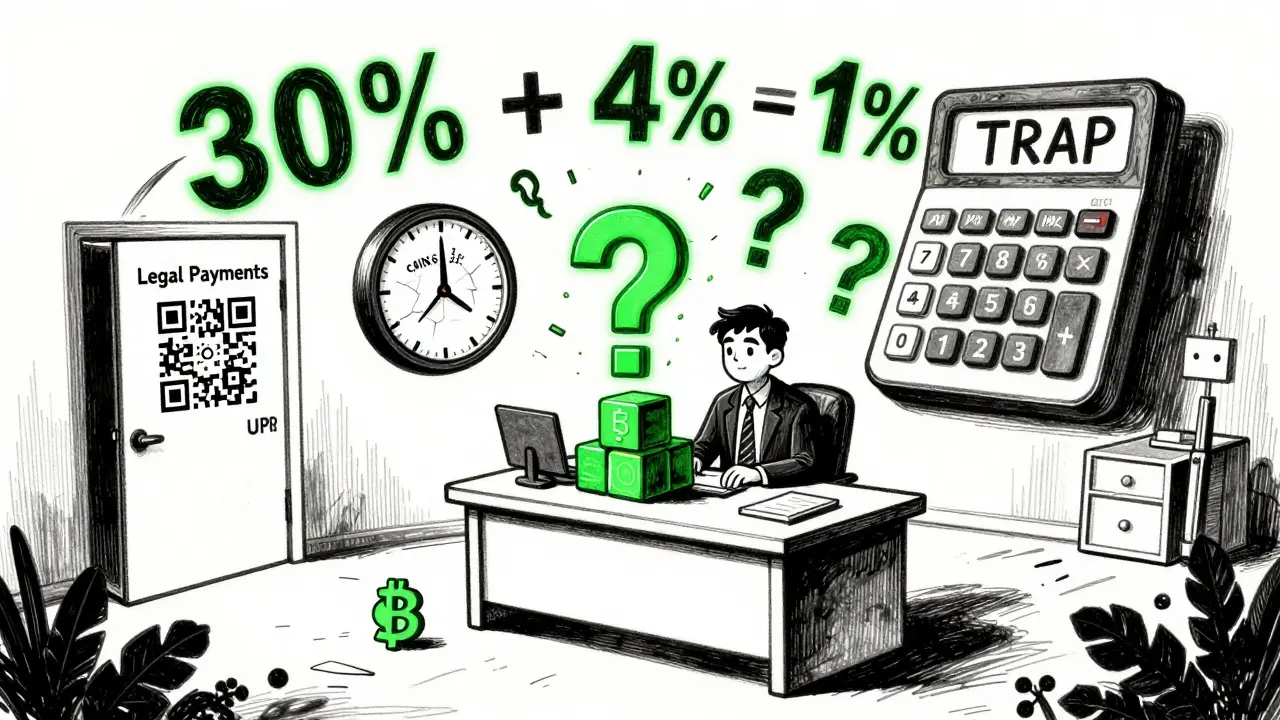

Even if you can’t accept crypto as payment, you can still earn it - through trading, staking, mining, or airdrops. And the government wants its cut. Since April 2022, all income from Virtual Digital Assets is taxed at a flat 30%, with no deductions allowed except the cost of acquisition. That’s higher than the top income tax slab for most individuals. On top of that, there’s a 4% cess, bringing the total tax rate to 31.2%. But here’s the catch that affects businesses directly: a 1% Tax Deducted at Source (TDS) applies to every crypto transfer. That means if your business receives crypto from a customer - even if it’s for services rendered - you’re required to deduct 1% as tax and remit it to the government. This rule applies regardless of transaction size. For example: if you sell a product for 1 ETH worth ₹50,000, you must deduct ₹500 as TDS and deposit it with the tax authorities. You can’t just keep the full ₹50,000. And if you don’t? You’re in violation. This TDS rule makes accepting crypto as payment practically unworkable for most businesses. You’re not just handling a payment - you’re becoming a tax collector for the government. And if you mess up the reporting, penalties can be steep.Compliance: KYC, AML, and FIU-IND Registration

If your business is involved in crypto - even if you’re just buying and selling it - you’re now under the same regulatory umbrella as banks. Since March 2023, all Virtual Digital Asset Service Providers (VDASPs) must register with the Financial Intelligence Unit of India (FIU-IND). This includes crypto exchanges, wallet providers, and any business that facilitates crypto transfers. The registration process requires detailed documentation: business structure, ownership details, KYC procedures, and AML policies. And compliance isn’t optional. Binance was fined ₹18.82 crore (about $2.17 million) in 2024 for failing to register. Bybit was hit with ₹9.27 crore ($1.07 million). Both companies had to shut down their Indian operations temporarily until they got registered. For a small business that wants to accept crypto, this means you need:- A registered business entity (Pvt Ltd, LLP, or OPC)

- A documented KYC process for every customer who sends you crypto

- A system to track every transaction with sender and receiver details

- Monthly reporting to FIU-IND

- Records kept for at least five years

The Travel Rule: India’s Strictest Crypto Rule

India is one of the few countries that enforces the FATF Travel Rule with no minimum threshold. That means every single crypto transfer - whether it’s ₹100 or ₹10 lakh - must include full sender and receiver information: name, address, ID number, wallet address. This isn’t just a suggestion. It’s a legal requirement. If you receive crypto without this data, you’re required to reject the transaction. If you accept it anyway, you risk being flagged for money laundering. For businesses, this makes accepting crypto nearly impossible. Most wallets don’t automatically send this data. Most customers don’t know how to provide it. And most point-of-sale systems can’t capture it. The burden falls entirely on the business to verify, record, and report every single transaction.What’s Coming Next? The COINS Act 2025

The government is working on the Comprehensive Regulation of Cryptographic Assets (COINS) Act 2025. If passed, this law could change everything. The draft proposes:- Formal recognition of crypto as a legal asset class

- Licensing of exchanges under RBI supervision

- Clearer TDS rules and possible deductions for trading fees

- Consumer protection against scams and fraud

- Defined rules for businesses using crypto

Real-World Examples: Who’s Doing It Right?

Some businesses are finding ways to work within the system:- Crypto exchanges like CoinDCX and ZebPay: They’re fully registered with FIU-IND, enforce KYC, and report TDS. They don’t accept crypto as payment - they facilitate trading.

- Blockchain development firms: They get paid in rupees for building smart contracts or dApps. They might hold crypto as an investment, but never as payment for services rendered.

- International freelancers: Some Indian freelancers receive crypto from overseas clients. They declare it as income, pay 30% tax, and file TDS returns. But they don’t use it to pay their vendors or employees.

What Happens If You Break the Rules?

If you’re a business that accepts crypto as payment:- You’re violating the legal tender rule

- You’re likely not collecting or depositing TDS

- You’re probably not registering with FIU-IND

- You’re not maintaining KYC records

- Income tax reassessment with penalties up to 200% of unpaid tax

- FIU-IND investigation for AML violations

- Freezing of your business bank account

- Criminal liability under the Prevention of Money Laundering Act

What Should You Do Instead?

If you want to accept digital payments, here’s what works:- Use UPI - it’s fast, free, and legal

- Accept credit/debit cards

- Prepare for the Digital Rupee (e₹) - the RBI’s CBDC is expected to roll out widely in 2026

- Invest in crypto as an asset - hold it long-term

- Start a crypto education platform

- Build a blockchain tool for businesses

- Offer crypto trading advisory - get paid in rupees

Final Reality Check

The Indian government doesn’t want to ban crypto. They want to control it. They want to tax it. They want to track every transaction. And they want to keep the rupee as the only real money. Accepting crypto as payment isn’t just risky - it’s legally unsound. The compliance costs, tax burdens, and regulatory exposure far outweigh any perceived benefits. Even if you think you’re being smart, you’re playing with fire. The future might change. The COINS Act could bring clarity. But until then, the rule is simple: crypto is an asset, not a currency in India.Can I accept Bitcoin as payment for my online store in India?

No. Accepting Bitcoin or any cryptocurrency as payment for goods or services is not legally permitted in India. While owning and trading crypto is allowed, the government does not recognize it as legal tender. Businesses that accept crypto as payment risk violating the legal tender rule and could face tax reassessments, FIU-IND investigations, and penalties under the Prevention of Money Laundering Act.

Do I have to pay tax if I receive crypto as payment?

Yes. Any income received in the form of cryptocurrency is treated as income from Virtual Digital Assets (VDAs) and is taxed at 30% plus 4% cess. Additionally, a 1% Tax Deducted at Source (TDS) applies to all crypto transfers, meaning you must deduct and deposit 1% of the transaction value with the tax authorities. Failure to comply can lead to penalties and legal action.

Is it legal to use crypto to pay employees or suppliers in India?

No. Paying employees or suppliers in cryptocurrency is not permitted under Indian law. Salaries and business payments must be made in Indian rupees. Using crypto for these purposes violates the legal tender rule and may trigger investigations by the Income Tax Department and FIU-IND for potential money laundering or tax evasion.

What happens if I don’t register with FIU-IND?

If your business facilitates crypto transactions and doesn’t register with FIU-IND, you’re violating the Prevention of Money Laundering Act (PMLA). Penalties include fines of up to ₹2 crore, freezing of business accounts, and potential criminal charges. Major exchanges like Binance and Bybit were fined over ₹25 crore combined in 2024 for non-compliance before registering.

Can I open a bank account for my crypto business in India?

It’s difficult, but possible. Many traditional banks still refuse to serve crypto businesses due to perceived risk. However, if you’re fully registered with FIU-IND, comply with KYC/AML rules, and maintain clean financial records, some banks - especially newer digital banks and fintech partners - will open accounts. You’ll need to demonstrate strong compliance, not just crypto activity.

Will the COINS Act 2025 allow businesses to accept crypto payments?

The draft COINS Act 2025 does not currently propose allowing crypto as legal tender. It focuses on licensing exchanges, defining crypto as a regulated asset, and improving tax clarity - not permitting its use for everyday payments. Even if passed, it’s unlikely to change the core rule: rupees remain India’s only legal currency. Crypto will remain an investment, not a payment method.

Can I accept crypto if I’m a freelancer working for clients abroad?

Yes - but only if you treat it as income, not as payment. You can receive crypto from foreign clients as payment for services, but you must declare it as income, pay 30% tax plus cess, and deduct 1% TDS. You cannot use that crypto to pay your Indian vendors or rent. You must convert it to rupees before spending it locally. The income is taxable; the currency isn’t usable.

Is there a way to legally accept crypto without registering with FIU-IND?

No. If your business facilitates any crypto transfer - even once - you fall under the definition of a Virtual Digital Asset Service Provider (VDASP). Registration with FIU-IND is mandatory. There are no exceptions for small businesses or occasional transactions. Ignorance of the law is not a defense.

Can I use crypto to pay for advertising or cloud services in India?

No. Even if the service provider accepts crypto, it doesn’t make it legal for you to pay with it. Indian law doesn’t recognize crypto as a valid payment method for any transaction within the country. You must pay for advertising, SaaS tools, or cloud services in rupees. Using crypto for these payments exposes you to tax and compliance risks.

What’s the safest way to get involved with crypto as a business in India?

The safest path is to avoid using crypto as payment. Instead, focus on crypto-related services that don’t require accepting it: blockchain development, crypto education, trading advisory, or investment management - all paid in rupees. Stay compliant with tax rules, register with FIU-IND if you’re a VDASP, and keep detailed records. Let crypto be an asset you trade, not a currency you spend.