Crypto Exchange Fee Calculator

Important Note

This calculator shows fee structures only. LOEx has significant security risks and no regulatory oversight. See article for full analysis.

| Exchange | Fee Structure | Estimated Fee |

|---|---|---|

| LOEx | Fixed 0.20% (no volume discounts) | |

| Kraken | 0.16% (maker), 0.26% (taker) | |

| Coinbase | 0.50% (standard) | |

| Binance | 0.10% (taker), 0.02% (maker) |

Security Warning

LOEx lacks proof of reserves, regulatory oversight, and security transparency. Even with low fees, these platforms pose significant risk. The article explains why LOEx is not a safe alternative despite its attractive fee structure.

If you’re looking at LOEx as a place to trade crypto, you’re not alone. The platform has been around since 2019, claims to be fast and secure, and has a flat 0.20% trading fee that looks tempting compared to bigger names like Binance or Coinbase. But here’s the real question: is LOEx a legit exchange-or just another lookalike scam hiding in plain sight?

First, let’s clear up the biggest confusion: LOEx (with an O) is not the same as LWEX (with a W). LWEX has been flagged by multiple users and watchdogs as a fraud. People report deposits disappearing, withdrawals blocked, and customer support vanishing after a few weeks. It’s a classic Ponzi setup: attractive fees, clean interface, and then silence. LOEx, on the other hand, is registered in Seychelles and has been operating under the Seychelles Financial Services Authority. That doesn’t mean it’s regulated like Coinbase or Kraken-it means it’s operating in a jurisdiction with light oversight. That’s a red flag if you’re used to U.S. or EU standards.

Trading Fees and Volume: Competitive, But Not Enough

LOEx charges a flat 0.20% fee for both maker and taker trades. That’s slightly below the global average taker fee of 0.217% and a bit above the average maker fee of 0.164%. On paper, it looks fair. But here’s the catch: there are no volume discounts. Binance gives you 0.10% or less if you trade more. Kraken drops fees to 0.00% for high-volume traders. LOEx doesn’t care how much you trade-you pay the same. That’s fine for casual traders, but if you’re moving large amounts, you’re leaving money on the table.

Back in 2021, LOEx hit $1.2 billion in 24-hour volume. That’s impressive growth-from $109 million to over a billion in just seven months. But as of 2025, that number hasn’t been updated. Meanwhile, Binance hits $35 billion daily. Coinbase does $12 billion. Kraken? Around $4 billion. LOEx is now a speck in the rearview mirror. It’s not in the top 10 anymore. It’s barely in the top 50. Volume doesn’t mean safety, but it does mean liquidity. Low liquidity means slippage. Slippage means you don’t get the price you expect. That’s costly when you’re trading altcoins.

What You Can and Can’t Trade

LOEx offers spot trading. That’s buying and selling crypto at current market prices. It also has OTC (Over-The-Counter) services for larger trades. But here’s what’s missing: futures, margin trading, staking, and lending. No options. No derivatives. No yield farming. If you’re looking to do anything beyond buy and sell, you’ll need another platform. That’s not a dealbreaker for beginners, but if you’ve been trading for a while, you’ll quickly outgrow it.

As for supported coins, LOEx lists major ones like Bitcoin, Ethereum, Solana, and a few others. But it doesn’t offer the 450+ coins Kraken does or the 250+ on Coinbase. You won’t find obscure memecoins or new DeFi tokens here. If you’re chasing the next Dogecoin or Shiba Inu, you’ll need to go elsewhere.

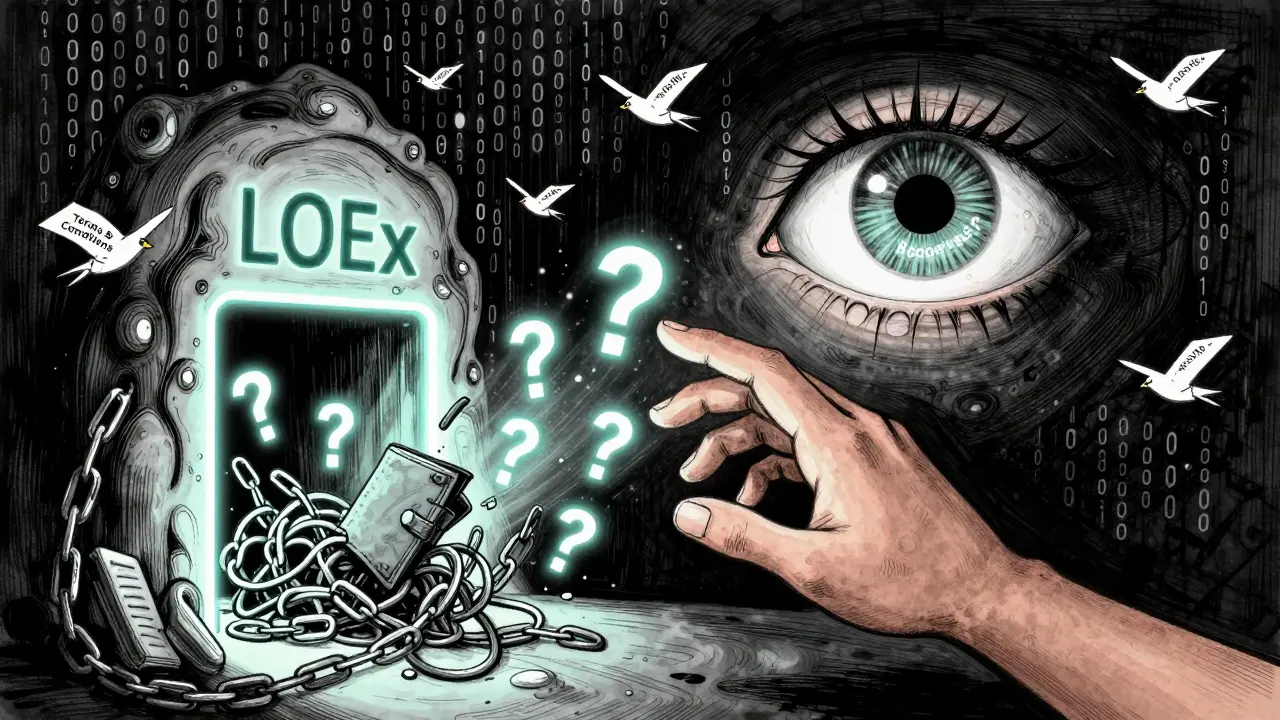

Security: The Big Question Mark

This is where LOEx gets shaky. Reputable exchanges in 2025 don’t just say they’re secure-they prove it. Kraken and Coinbase publish monthly proof-of-reserves reports. They use biometric logins, cold storage for 95%+ of funds, and mandatory two-factor authentication. LOEx? No public proof of reserves. No details on cold storage. No mention of biometric login. The website says it’s “safe and reliable,” but that’s marketing speak. No third-party audit reports. No insurance disclosures. No transparency.

And here’s the scary part: the name “LOEx” is so close to “LWEX”-a known scam platform-that it’s almost certainly intentional. Scammers copy names to trick people. DataVisor found that fake exchanges use low fees and clean UIs to lure users, then disappear with their money. LOEx hasn’t been proven to be a scam, but it hasn’t proven it’s safe either. In a market where even Binance lost $1.5 billion in 2022 due to poor oversight, you can’t afford to guess.

Fiat On-Ramps and Withdrawals

Can you deposit USD, EUR, or GBP? Probably not directly. LOEx doesn’t list any fiat on-ramp partners like Bank Transfer, Apple Pay, or PayPal. That means you need to buy crypto on another exchange first-like Coinbase or Kraken-and then transfer it over. That’s an extra step, extra fees, and extra risk. If you’re new to crypto, this makes LOEx unnecessarily complicated.

Withdrawal times? Unknown. No user reports or official timelines are available. For legitimate exchanges, crypto withdrawals take minutes. Fiat withdrawals take 1-3 business days. With LOEx, you’re flying blind. If your funds get stuck, who do you call? The website has a support form, but there’s zero evidence of response speed or success rate. Compare that to Kraken’s 24/7 live chat or Coinbase’s ticket system with 90% resolution in under 24 hours. LOEx offers nothing.

Who Is LOEx For?

LOEx might work for one kind of person: someone who already owns crypto, wants to do a quick trade, doesn’t care about regulation, and is okay with zero transparency. Maybe you’re testing the waters with a small amount. Maybe you’re in a country where major exchanges are blocked. Maybe you’re just lucky.

But if you’re serious about crypto-whether you’re holding long-term, trading actively, or managing a portfolio-LOEx is not the place. The lack of security proof, regulatory oversight, and feature depth makes it a risky bet. And in 2025, after the FTX collapse, the Celsius implosion, and dozens of other scams, users don’t have the luxury of trusting vague promises.

Alternatives That Actually Deliver

If you want safety, go with Kraken. It’s SEC-registered, publishes proof-of-reserves, supports 450+ coins, and has 24/7 support. Fees start at 0.16% and drop with volume.

If you want ease of use, go with Coinbase. It’s the most user-friendly, regulated in the U.S., and lets you buy crypto with a debit card. Fees are higher (0.05%-0.60%), but the experience is smooth.

If you want volume and low fees, go with Binance. It’s the biggest, cheapest, and most feature-rich-even if its regulatory status is shaky in some countries.

None of these platforms hide behind vague claims. They show you their licenses, their audits, their reserves. LOEx doesn’t.

Final Verdict

LOEx isn’t officially a scam. But it’s not a safe choice either. It’s in a gray zone: operational, with decent volume years ago, but now silent on updates, security, and compliance. In 2025, the bar for trust in crypto exchanges has never been higher. You need proof, not promises.

If you’re trading $100 or $500 just to see how it works, fine. But if you’re putting in more than that, you’re gambling-not trading. And in crypto, gambling doesn’t pay off in the long run.

Stick with exchanges that show their work. Not the ones that just say they’re “technologically efficient.”

Is LOEx a scam?

LOEx isn’t officially listed as a scam, but it shares the same name structure as LWEX, which is a known fraudulent platform. LOEx lacks proof of reserves, regulatory licensing, and transparent security practices-all of which are standard for trustworthy exchanges in 2025. Without these, it’s impossible to confirm its legitimacy, making it a high-risk choice.

Does LOEx support fiat deposits?

No, LOEx does not offer direct fiat on-ramps. You can’t deposit USD, EUR, or GBP directly. You’ll need to buy crypto on another exchange like Coinbase or Kraken and transfer it to LOEx. This adds complexity and extra fees, making it inconvenient for beginners.

What are LOEx’s trading fees?

LOEx charges a flat 0.20% fee for both maker and taker trades. That’s slightly below the industry average for taker fees but higher than the maker average. Unlike Binance or Kraken, there are no volume discounts or VIP tiers, so your fees stay the same no matter how much you trade.

Can I trade futures or staking on LOEx?

No, LOEx only offers spot trading and OTC services. It does not support futures, margin trading, staking, or lending. If you want to earn interest on your crypto or trade leveraged positions, you’ll need to use another exchange like Binance or Kraken.

Is LOEx regulated?

LOEx is registered in Seychelles under the Seychelles Financial Services Authority, but it has no licensing from major regulators like the SEC (U.S.), FCA (UK), or ESMA (EU). This means it operates under minimal oversight. In 2025, most reputable exchanges are licensed in multiple jurisdictions-LOEx is not.

How do I know if I’m on the real LOEx site?

Always check the exact URL: it must be "loex.com" or a verified subdomain. Avoid any site with "lwex" in the name-that’s a known scam. Also, check for HTTPS, official social media links, and domain age. Fake exchanges often use newly registered domains and copy the design of real ones. If it looks too good to be true, it probably is.

What should I do if I already deposited funds on LOEx?

If you’ve deposited funds, don’t add more. Monitor your account closely. Try to withdraw a small amount first to test the process. If withdrawals are delayed or blocked, stop using the platform immediately. Save all transaction IDs and communication records. Consider reporting it to your local financial authority or consumer protection agency. Never assume a platform will return your funds without proof of security and regulation.

Bottom line: LOEx might look like a quiet, low-fee option-but in today’s crypto world, that’s exactly how scams hide. Stick with exchanges that prove they’re trustworthy, not ones that just say they are.

Kurt Chambers

December 12, 2025 AT 01:52LOEx? More like LO-SCAM. They're just copying LWEX's name so dumb people click on it. USA has real exchanges, why are you even wasting time on some Seychelles ghost site? You think a flat fee means you're getting a deal? Nah, you're getting a one-way ticket to crypto oblivion. Wake up, sheeple.

Kelly Burn

December 12, 2025 AT 08:45Okay but like… 🤔 LOEx’s UI is actually kinda sleek? I get the red flags - no proof of reserves, no staking, the name similarity to LWEX is sketchy as hell 😬 - but what if it’s just a small, quiet player trying to survive? Not every exchange needs to be Binance. Maybe it’s the crypto equivalent of that cozy coffee shop no one knows about but the barista remembers your order? 🫖 #CryptoEthics #TransparencyMatters

Vidhi Kotak

December 12, 2025 AT 13:13For beginners, LOEx might seem tempting because of the simple interface and low fee - but you're right, the lack of fiat on-ramps and withdrawal transparency makes it risky. If you're just testing with $50, maybe it's okay. But if you're holding more than that, you're playing Russian roulette with your crypto. Stick to Kraken or Coinbase - they’ve got the audits, the support, and the track record. Don’t let a clean logo fool you. Safety first, always.

Steven Ellis

December 14, 2025 AT 06:37The psychological manipulation here is fascinating - LOEx leverages the allure of simplicity and low fees to mask profound institutional opacity. In a post-FTX world, where trust is the most volatile asset, platforms that refuse to publish reserves or undergo third-party audits aren't merely non-compliant - they're fundamentally incompatible with the ethical infrastructure of decentralized finance. This isn't just a bad exchange; it's a systemic failure of accountability disguised as convenience.

Kathy Wood

December 15, 2025 AT 09:44Rakesh Bhamu

December 16, 2025 AT 14:39Good breakdown - I’ve seen similar platforms in India too. They look legit, charge low fees, and vanish after 6 months. LOEx might not be a scam yet, but it’s on the path. If you’re using it, treat it like a temporary bridge - not a home. And always keep 90% of your holdings in cold storage elsewhere. No exchange, no matter how clean its website, deserves full trust.

Madison Surface

December 16, 2025 AT 16:32Wait - so if LOEx doesn’t even have staking… then how are people making passive income? Are they just buying and holding? That’s… kinda sad? I mean, crypto’s about earning, not just flipping. And if you can’t even withdraw your funds without a 3-week wait and a prayer? I’d rather pay 0.5% on Coinbase and sleep at night. This feels like trusting a stranger with your house key because they smile a lot.

Tiffany M

December 17, 2025 AT 19:19LOEx? More like LO-SCAM-EX. They’re literally riding the coattails of a known fraud. And you call that ‘operating in Seychelles’? That’s like saying a fake Rolex is ‘Swiss-inspired’. It’s not a gray zone - it’s a black hole. If you’re not using Kraken or Coinbase, you’re not trading - you’re donating to someone’s yacht fund. 🚤💸

Eunice Chook

December 18, 2025 AT 03:52Low fees? Cute. But in crypto, ‘low fees’ is the bait. The hook is your life savings. LOEx doesn’t need to be a scam to be dangerous - it just needs to be negligent. And negligence is just fraud with better PR. If you’re still using this, you’re not a trader. You’re a case study.