For millions of Bangladeshis working abroad, sending money home isn’t just a transaction-it’s survival. In fiscal year 2024-25, remittances hit a record $30 billion, up 27% from the year before. That’s more than the country’s entire garment export industry. But here’s the twist: while this money flows in faster and more reliably than ever, using cryptocurrency to send it is still illegal. Not risky. Not discouraged. Flat-out banned.

How Bangladesh’s Remittance Machine Got So Big

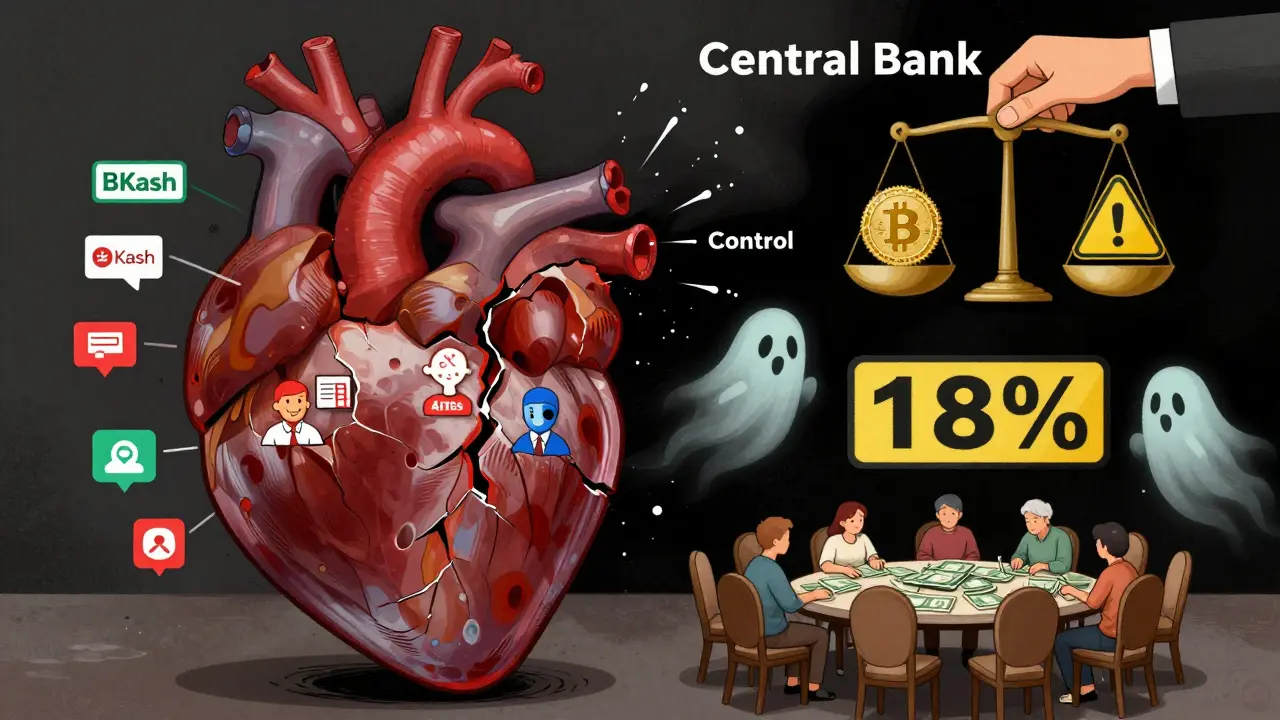

The numbers don’t lie. In March 2025 alone, Bangladesh received $3.29 billion in remittances-up from $1.99 billion the same month the year before. July 2025 saw $2.48 billion. The first quarter of FY2025-26 brought in $7.59 billion. That’s not a fluke. It’s the result of deliberate policy changes. The central bank, Bangladesh Bank, cracked down on informal networks like hundi, a cash-based system that had long operated in the shadows. With political shifts and tighter oversight, workers stopped using unregulated channels. Instead, they turned to banks, mobile apps like bKash and Nagad, and agent banking networks. These services now handle 87% of all remittances, up from 62% just two years ago. Real-time systems have replaced slow, paper-heavy processes. The new Real-Time Gross Settlement system cuts transfer times from days to under four hours for most transactions. The government’s own “Remittance Direct” app, launched in August 2025, has moved $1.2 billion with average fees of just 3.8%-well below the national average of 5.2%. That’s progress. But the cost is still too high. The World Bank says the average fee to send money to Bangladesh is 6.5%. The global target? 3%. For a worker sending $500 home, that’s $32.50 in fees. Some users report losing $300 in fees on a $500 transfer from Malaysia. Others say exchange rates vary wildly between banks, sometimes by 1.2%. These aren’t minor annoyances-they eat into the money families rely on.Why Cryptocurrency Is Still Forbidden

While countries like India and Pakistan are testing regulated crypto pathways for remittances, Bangladesh has dug in. Since 2017, the central bank has banned all cryptocurrency transactions under Section 33 of the Foreign Exchange Regulation Act. No exceptions. No gray areas. The reasons are clear: monetary control and financial stability. Bangladesh Bank officials say crypto could undermine the taka, create money laundering risks, and destabilize the banking system. Deputy Governor Ahmed Munas put it bluntly in September 2025: “Cryptocurrencies pose unacceptable risks to monetary sovereignty.” The ban isn’t just policy-it’s enforced. In September 2025, Bangladesh Bank issued Warning Notice No. BB/CC/2025/17, threatening license revocation and criminal prosecution for any entity facilitating crypto remittances. Banks, mobile wallet providers, and fintech firms are all on notice. Diaspora communities are split. A Facebook group with 587,000 Bangladeshi expats found that 63% are frustrated with slow, expensive traditional channels. But only 12% have even tried crypto-mostly because they fear arrest or bank account freezes. One Reddit user in the r/Bangladesh thread wrote: “I know I could send crypto and save $50, but my cousin got his account locked last year for trying. Not worth it.”Who’s Sending Money, and Where It Comes From

The flow isn’t random. Over two-thirds of remittances come from the Middle East: Saudi Arabia, UAE, and Qatar lead the pack. The U.S. contributes 12.7%, Malaysia 8.4%. That’s because 7.5 million Bangladeshi workers are employed abroad, mostly in construction, domestic work, and healthcare. The top five remittance providers account for nearly half the market. Sonali Bank holds 18.7%, bKash 15.2%, BRAC Bank 12.4%. These aren’t just banks-they’re lifelines. BRAC Bank’s digital platform cut Middle Eastern transfer times by 40%. bKash, with over 1.2 million Google Play reviews, has a 4.2/5 rating. But even here, users complain about delays and hidden fees.

The Human Cost of Being Locked Out of Crypto

Imagine you’re a nurse in Dubai. You earn $1,200 a month. You want to send $800 home to your family. With traditional channels, you pay $52 in fees. If crypto were legal, you could send it directly to your sister’s wallet, bypassing intermediaries, paying $5 or less, and having it settle in minutes. But it’s not legal. So you wait. You fill out forms. You visit an agent. You wait again for the money to appear in your sister’s bKash account-sometimes taking three days. Meanwhile, inflation in Bangladesh eats away at the value of the taka. The delay isn’t just inconvenient-it’s costly. Some try to sneak around the rules. They use peer-to-peer crypto platforms, then convert to cash through local brokers. But these are dangerous. If caught, they risk fines, jail, or being blacklisted from future remittances. The central bank monitors transactions closely. Suspicious activity triggers automatic alerts.What’s Next? Digital, Not Decentralized

Bangladesh Bank isn’t ignoring innovation. It’s just steering it differently. The central bank is working with India’s Reserve Bank to integrate the Unified Payments Interface (UPI) by mid-2026. That will let workers in India send money instantly to Bangladeshi mobile wallets-no banks needed. They’re also exploring a central bank digital currency (CBDC), not for speculation, but for efficiency. A government-backed digital taka could reduce fees, improve tracking, and eliminate intermediaries-all without touching crypto. The goal? 95% of remittances processed digitally by 2027. No mention of Bitcoin. No talk of Ethereum. Just faster, cheaper, regulated digital payments.

Is This Sustainable?

Experts are divided. Dr. Khondoker Muzammel Huq, former Bangladesh Bank chairman, calls the growth a “testament to diaspora patriotism.” But Dr. Ahsan H. Mansur warns it might be temporary-tied to political shifts and global labor trends, not lasting reforms. The Asian Development Bank predicts 15-18% growth in FY2026. But independent economist Dr. Birupaksha Paul says without tackling high fees and poor financial access, growth will stall at $33-35 billion. Right now, the system works better than ever. But it’s still not fair. Rural recipients without National ID cards or mobile banking access are left behind. One UNDP study found 18% of rural families can’t fully benefit from the remittance boom.The Bottom Line

Bangladesh has built one of the most successful remittance systems in the world. It’s faster, safer, and more transparent than before. But it’s also rigid. The ban on cryptocurrency isn’t about technology-it’s about control. And for now, that control trumps innovation. Workers abroad aren’t asking for Bitcoin. They’re asking for lower fees, faster transfers, and fewer middlemen. If the government can deliver that through its own digital tools, maybe crypto doesn’t need to be part of the story. But if it can’t? Then the gap will keep growing-and so will the temptation to break the rules.Is it illegal to use cryptocurrency for remittances in Bangladesh?

Yes. Since 2017, Bangladesh Bank has banned all cryptocurrency transactions under Section 33 of the Foreign Exchange Regulation Act. Any entity facilitating crypto remittances risks license revocation and criminal prosecution. The ban remains strict as of 2026, with no exceptions for personal use or remittances.

Why doesn’t Bangladesh allow crypto for remittances like India or Pakistan?

Bangladesh prioritizes monetary sovereignty and financial stability over innovation. Unlike India and Pakistan, which are testing regulated crypto frameworks, Bangladesh Bank views decentralized currencies as a threat to the taka, a tool for money laundering, and a risk to banking system integrity. The central bank has explicitly stated it will not relax the ban until its own regulatory infrastructure is stronger.

How much do people pay to send remittances to Bangladesh?

The average fee is 6.5%, according to the World Bank’s 2024 data-well above the global target of 3%. However, newer services like Bangladesh Bank’s "Remittance Direct" app charge as little as 3.8%, and mobile wallets like bKash offer competitive rates. Fees vary by sender country, provider, and transfer method, with informal channels sometimes charging over 10%.

What are the main ways people send money to Bangladesh now?

The most common methods are direct bank transfers, mobile financial services (bKash, Nagad), agent banking, and post office remittances. Over 87% of remittances now flow through digital channels. bKash alone handles 15.2% of the market. These services are faster and more secure than the old hundi system, which has nearly disappeared.

Can I use crypto to send money to Bangladesh without getting caught?

Technically, you might avoid detection-but it’s extremely risky. Bangladesh Bank monitors financial institutions closely and can freeze accounts, revoke licenses, or press criminal charges. There are no legal loopholes. Even if you use peer-to-peer crypto exchanges, converting crypto to cash locally could trigger fraud investigations. Most expats avoid it entirely to protect their banking access and avoid legal trouble.

Will Bangladesh ever allow crypto remittances in the future?

Not anytime soon. Bangladesh Bank Governor Dr. Ahsan H. Mansur stated in October 2025 that "cryptocurrency has no place in Bangladesh’s remittance ecosystem for the foreseeable future." Instead, the bank is focused on its own digital taka (CBDC) and integrating with India’s UPI system. The goal is control-not decentralization.

kelvin joseph-kanyin

February 13, 2026 AT 08:13Crystal McCoun

February 13, 2026 AT 08:58