When you use WBTC on Ethereum, you’re not holding Bitcoin. You’re holding a digital stand-in - a token that claims to be worth exactly 1 BTC. That’s the promise of wrapped tokens: they let you move assets like Bitcoin, Solana, or Avalanche coin across blockchains without actually moving the original. But here’s the catch - if the bridge locking those original assets gets hacked, your WBTC becomes worthless. And suddenly, so do the millions in DeFi loans, yield farms, and liquidity pools that rely on it.

How Wrapped Tokens Work (And Why They’re Risky)

Wrapped tokens are created when an asset is locked on its home chain and an equivalent token is minted on another. For example, you send 1 BTC to a custodian. They lock it in a vault and issue 1 WBTC on Ethereum. You can now use WBTC in Uniswap, Aave, or Curve - anywhere Ethereum DeFi lives. To get your BTC back, you burn the WBTC, and the custodian unlocks your BTC.

It sounds simple. But every step introduces risk.

The custodian holds the keys. If they’re compromised, your BTC is gone. If their smart contract has a bug, someone might mint 10,000 WBTC without locking any BTC. If the multi-sig wallet controlling the vault is hacked, attackers can drain the entire reserve. And because wrapped tokens are used as collateral in DeFi, one bridge failure can trigger chain reactions - liquidations, insolvencies, and market crashes.

The Two Biggest Threats to Wrapped Token Security

Not all attacks look the same. Two patterns dominate the worst exploits:

- Undercollateralization: Attackers withdraw the original asset (say, BTC) without burning the corresponding wrapped token. Now there’s less BTC backing WBTC than there should be. The bridge is running on empty. WBTC holders wake up to find their tokens are no longer fully backed - and their value plummets.

- Infinite minting: A bug in the smart contract lets someone mint unlimited wrapped tokens without locking any real assets. Suddenly, 10 million WBTC floods the market. The attacker sells it on DEXs, uses it as collateral to borrow ETH, then vanishes. The bridge collapses under its own fake supply.

Both attacks destroy trust. And once trust is broken, the token becomes unusable. No DeFi protocol will accept it as collateral. No exchange will list it. It’s dead money.

How Secure Bridges Protect Assets

The best wrapped token bridges don’t rely on one layer of security - they stack them.

- Cold storage: Over 90% of the locked assets sit in offline vaults. No internet connection. No remote access. Even if hackers breach the bridge’s website, they can’t touch the real BTC, ETH, or SOL.

- Multi-signature wallets: Withdrawals require approval from 3-5 different parties - often from separate companies or teams. No single person can move funds.

- MPC (Multi-Party Computation): Instead of storing private keys, MPC splits the key into fragments. Each fragment is held by a different node. No one has the full key. Funds can only be unlocked when enough fragments come together - and even then, only under strict rules.

- Smart contract audits: Reputable bridges hire at least two independent firms to audit their code. These aren’t checklists - they’re deep dives into edge cases, reentrancy bugs, and logic flaws. Audits are made public. If a bridge won’t show you theirs, walk away.

ChainPort, for example, uses Fireblocks and Gnosis Safe to manage signatures. Less than 5% of assets are kept on hot wallets - just enough to handle daily withdrawals. The rest? Locked in air-gapped vaults.

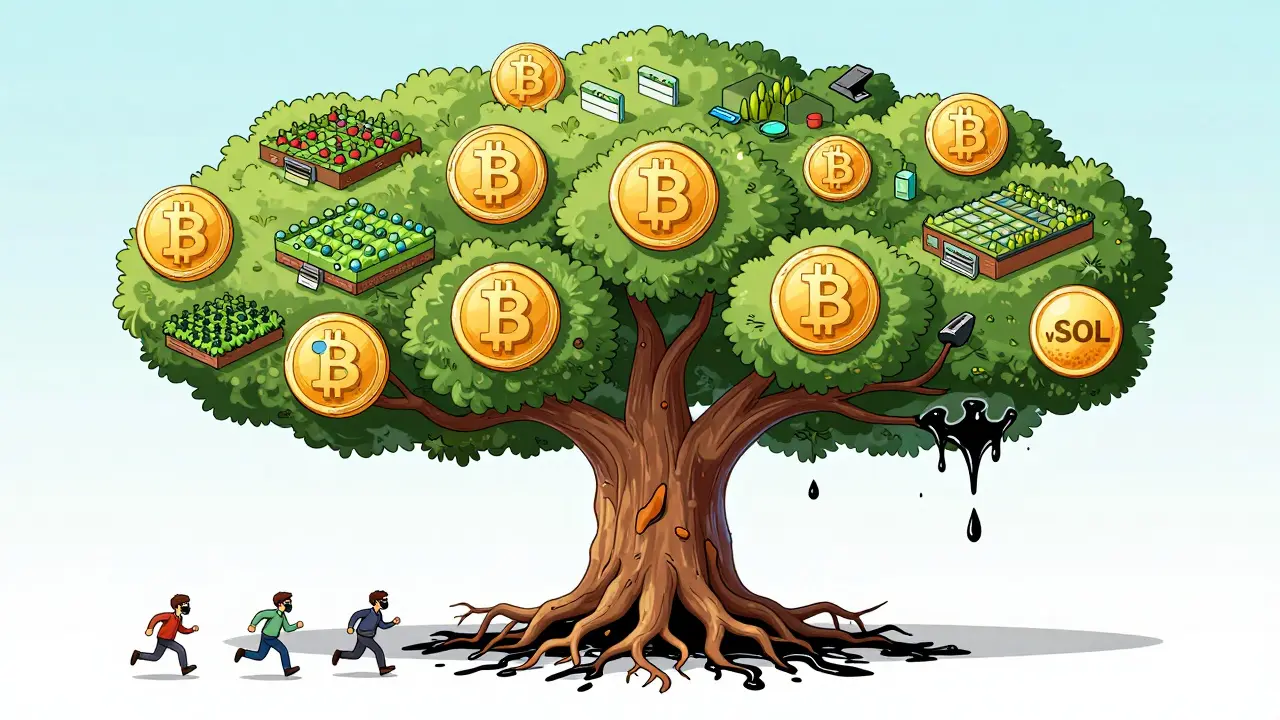

Why You Can’t Ignore Wrapped Token Risk

You might think: “I’m not using wrapped tokens. I’m just lending ETH on Aave.”

That’s the trap.

Wrapped tokens are everywhere. WBTC is the #1 collateral asset on Aave. wstETH is used in Curve pools. wSOL powers lending on Solana-based DeFi. If WBTC gets hacked, Aave’s entire collateral system is at risk. Lenders lose money. Borrowers get liquidated. The whole market shudders.

A bridge exploit isn’t just a bridge problem. It’s a systemic risk.

In 2022, the Poly Network hack stole $600 million across chains - and wrapped tokens were part of the chain reaction. In 2023, a single contract flaw in a minor bridge caused $80 million in WBTC to be drained. The market didn’t crash - but dozens of DeFi protocols had to freeze withdrawals for days.

What to Look for Before Using a Wrapped Token

Not all wrapped tokens are created equal. Here’s what to check:

- Is the bridge audited? Look for public reports from firms like CertiK, Trail of Bits, or OpenZeppelin. If there’s no report, avoid it.

- How much is in cold storage? If more than 20% of assets are on hot wallets, the risk is too high.

- Who controls the keys? Is it a single company? Or a decentralized group of trusted validators? Decentralized control = less single point of failure.

- Is there insurance? Some bridges partner with Nexus Mutual or InsurAce to cover losses. It’s not perfect, but it’s a safety net.

- How long has it been live? A bridge with 2+ years of uptime and zero exploits is far safer than one launched last month.

WBTC, for example, is managed by a consortium of 13 trusted custodians - including BitGo and Coincover - with daily audits and full transparency. That’s why it’s still the most trusted wrapped BTC.

The Future: Trustless Bridges and the End of Custodians

The current model - where you trust a custodian to hold your Bitcoin - is fundamentally flawed. It’s centralized. It’s fragile. It’s the opposite of blockchain’s promise.

New solutions are emerging. Projects like LayerZero and Axelar are building trustless bridges that use cryptographic proofs instead of custodians. Instead of locking BTC, they prove BTC was sent using Bitcoin’s own consensus rules. No middleman. No vaults. No single point of failure.

They’re not perfect yet. They’re slower. More expensive. Still in early testing. But they’re the future.

Until then, wrapped tokens are a necessary evil. They unlock DeFi. They connect chains. But they also concentrate risk.

Use them. But don’t trust them blindly.