DeFi Explained: How Decentralized Finance Is Changing Crypto Trading

When you hear DeFi, short for decentralized finance, it means financial services built on blockchain that don’t need banks, brokers, or middlemen. Also known as open finance, it lets you lend, borrow, trade, and earn interest using just a crypto wallet and an internet connection. This isn’t theory—it’s what people in Nigeria use to save money when local banks freeze accounts, what Cubans rely on to get paid from abroad, and what Indian traders turn to when traditional systems feel too slow or expensive.

Decentralized exchanges, or DEXs, are the backbone of DeFi. Unlike regular exchanges like Binance or Coinbase, you don’t hand over your keys. You trade directly from your wallet using smart contracts. Platforms like PancakeSwap, a popular DEX on Binance Smart Chain that cuts trading fees to near zero, or ApertureSwap, a privacy-focused DEX on Manta Pacific that hides your trade history, show how flexible and varied DeFi tools can be. You’re not just swapping tokens—you’re interacting with code that runs 24/7 without a CEO or customer service line. And it’s not just trading. DeFi includes lending protocols, yield farms, stablecoins like USDC, and even insurance contracts—all running on blockchains like Ethereum, Avalanche, or Linea. Some of these tools are risky, some are barely used, but the ones that work? They’re changing how money moves globally.

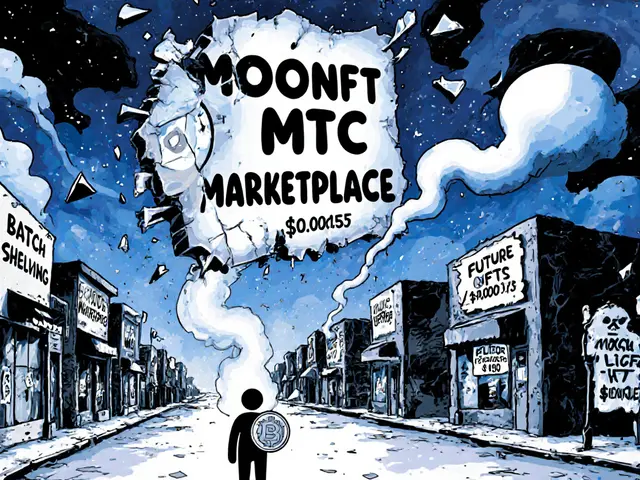

What you’ll find here aren’t hype pieces or coin promotions. These are real reviews of platforms people actually use—or avoid. From a DEX that offers gasless trades to exchanges shut down for lacking KYC, from fan tokens that feel like merch to tokens with zero volume and no team, this collection cuts through the noise. You’ll learn what DeFi actually looks like on the ground: the good, the broken, and the outright scams. No fluff. Just what you need to know before you connect your wallet.

DeFi vs Traditional Banking: Key Differences in Speed, Fees, Access, and Security

DeFi offers faster transactions, higher yields, and global access without banks - but with less protection. Traditional banking is slower and more expensive, but safer and regulated. Here's how they really compare in 2025.