DEX Explained: What Decentralized Exchanges Are and Why They Matter

When you trade crypto on a DEX, a decentralized exchange that lets users trade directly from their wallets without a central authority. Also known as non-custodial exchange, it removes banks, brokers, and middlemen from the process. That sounds simple—until you realize most platforms calling themselves DEXs aren’t real ones. Some are fake, others are poorly built, and a few are outright scams designed to steal your keys. A true DEX runs on smart contracts, lets you control your own funds, and doesn’t require KYC. But not every platform with ‘DEX’ in its name meets those standards.

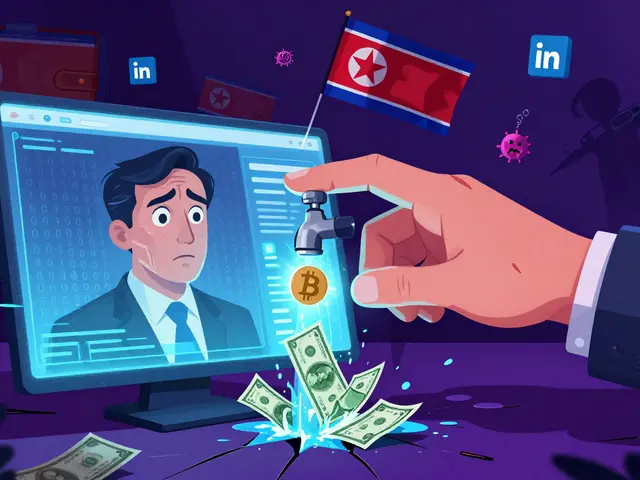

Real DEXs like PancakeSwap, a popular decentralized exchange built on Binance Smart Chain that enables low-cost token swaps or Uniswap, an Ethereum-based DEX that uses automated market makers to facilitate trades without order books work because they’re open, audited, and have real users. But look at Horizon Dex or ko.one—these aren’t DEXs at all. They’re empty websites with no trading engine, no liquidity, and no track record. They trick people into connecting wallets, then drain them. The same goes for fake airdrops tied to DEXs: if a site asks you to send crypto to claim free tokens, it’s not a DEX—it’s a trap.

Why does this matter? Because DEXs are the backbone of DeFi, a system of financial applications built on blockchain that operates without traditional banks or intermediaries. They let people in countries with banking bans—like India, Cuba, or Bangladesh—access global markets. They let traders avoid KYC when they want privacy. But they also demand responsibility. If you don’t understand how order books work, or how to check liquidity, you’ll get ripped off. Market depth isn’t just a buzzword—it’s what keeps your trade from slippage. And if a token’s trading volume is fake, like SakeToken or Moonft, your DEX trade could vanish instantly.

Some DEXs are built for speed, like PancakeSwap v2 on Linea, slashing gas fees to pennies. Others, like MintMe.com, let you create your own token—but that doesn’t make it valuable. Creating a token is easy. Making it useful? That’s hard. And if a project has no team, no audits, and no users—like BSC AMP or FOC TheForce.Trade—it’s not DeFi. It’s a ghost.

What you’ll find here isn’t just a list of DEXs. It’s a guide to spotting the real ones from the fakes. You’ll see how governments are shutting down no-KYC platforms, why some exchanges vanish overnight, and how scams hide behind the word ‘DEX’. You’ll learn what to check before you swap, what red flags mean danger, and which projects actually deliver on their promises. This isn’t theory. It’s what’s happening right now—on the ground, in the wallets, and in the courts.

How to Use a Decentralized Exchange: A Step-by-Step Guide for Beginners

Learn how to use a decentralized exchange safely and effectively. Step-by-step guide for beginners on swapping crypto with MetaMask, avoiding common mistakes, and using Layer 2 networks to save on fees.