Smart Contract Auditing: Why It Matters and What You Need to Know

When you interact with a smart contract, a self-executing program on a blockchain that runs without human intervention. Also known as on-chain code, it handles everything from token swaps to lending and staking — but if it’s broken, your money can vanish instantly. That’s where smart contract auditing, a detailed review of blockchain code to find security flaws before launch. It’s the equivalent of a mechanic checking your car’s brakes before a highway trip comes in. Most crypto losses aren’t from hacking or market crashes — they’re from poorly written code that no one bothered to check.

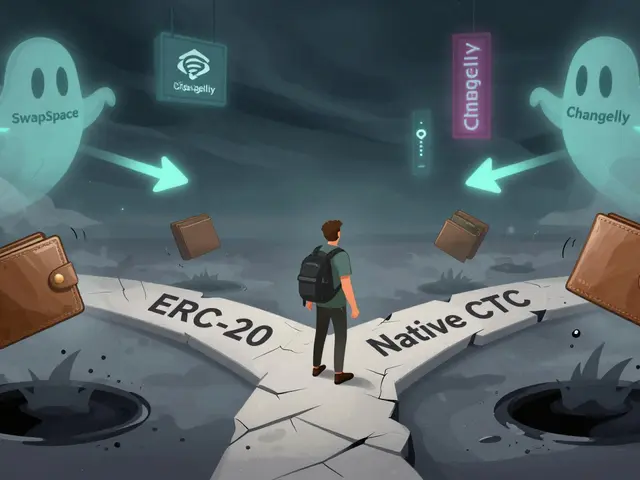

Think of it this way: if you’re swapping tokens on a decentralized exchange, a platform that lets users trade crypto directly without a middleman. It relies entirely on smart contracts to match orders and move funds, you’re trusting that code to work perfectly. But as seen with platforms like Horizon Dex and ko.one in the posts below, many exchanges skip audits entirely. The result? Wallets drained, tokens worth $0, and no recourse. Even legitimate-looking projects like BSC AMP or FOC TheForce.Trade turned out to be empty shells because no one verified their code. Audits don’t guarantee safety — but they’re the only real filter you have.

Not all audits are equal. Some firms just run automated tools and call it done. The good ones manually trace every line of code, simulate attacks, and check for reentrancy bugs, overflow errors, and unauthorized access paths. Projects like Flux Protocol and Apertum that mention audits in their docs tend to be more trustworthy. Meanwhile, meme coins like ElonDoge or Moonft? No audits. No team. No future. If a project won’t share its audit report — or worse, makes you pay to see it — walk away. Real teams post them publicly. You can also spot red flags in posts about fake airdrops like VDV VIRVIA or AFEN Marketplace — those scams often use unverified contracts to steal your keys the second you connect your wallet.

Smart contract auditing isn’t just for experts. If you’re using any DeFi tool, buying a new token, or joining an airdrop, you should ask: Was this code checked? The difference between a safe investment and a total loss often comes down to one audit report. Below, you’ll find real-world examples of what happens when audits are ignored — and what to look for when they’re done right.

Top Smart Contract Auditing Firms in 2025

Top smart contract auditing firms in 2025 include CertiK, ConsenSys Diligence, OpenZeppelin, Cyfrin, SlowMist, and Hashlock. Each offers unique strengths in security, speed, and expertise for DeFi, NFTs, and blockchain apps.