Stablecoins Explained: How They Keep Crypto Stable and Where They're Used

When you buy Bitcoin or Ethereum, you’re betting on price swings. But what if you wanted crypto that doesn’t jump up and down? That’s where stablecoins, cryptocurrencies designed to hold a steady value by being tied to real-world assets like the US dollar. Also known as digital dollars, they let you hold crypto without risking your savings to market chaos. They’re not just for traders—they’re used by people in countries with unstable currencies, by businesses sending payments across borders, and even by everyday users who want to move money fast without bank delays.

Stablecoins like USDT, the most widely used stablecoin, backed by reserves and traded on nearly every exchange, and USDC, a transparent, regulated stablecoin issued by a major financial company, are the backbone of crypto trading. You use them to buy other coins without cashing out to fiat. In places like India, Cuba, or Bangladesh—where banks block crypto or impose heavy taxes—people turn to stablecoins to send money home, buy goods, or protect savings from inflation. Even in places with bans, like North Macedonia or Turkey, stablecoins slip through as the quiet workhorse of underground crypto use.

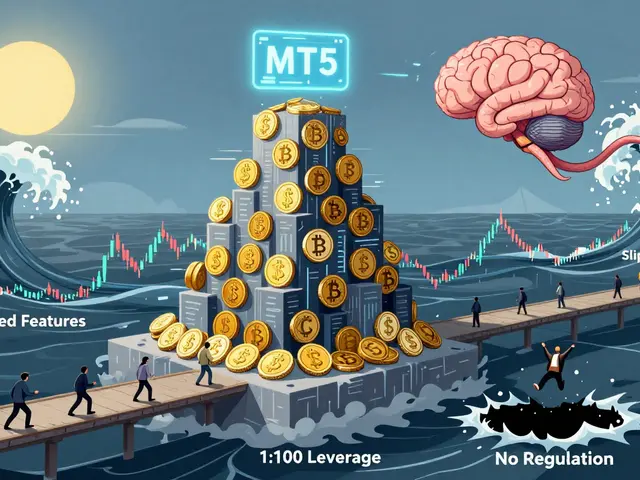

Not all stablecoins are the same. Some are backed by cash, others by other crypto, and a few use complex algorithms to stay stable. DAI, a decentralized stablecoin created by MakerDAO that’s collateralized by crypto assets, not bank accounts, lets users avoid relying on any single company. That’s why it’s popular in DeFi, where trust in centralized systems is low. But here’s the catch: if the backing isn’t real, the stablecoin isn’t stable. That’s why so many posts here warn about fake tokens, shady exchanges, and scams pretending to offer free stablecoins. You need to know what’s real.

What you’ll find below isn’t just theory. It’s real-world stories: how people in India bypass taxes using stablecoins, how Cubans use them to survive sanctions, and why platforms claiming to give away free stablecoins are almost always traps. You’ll see how stablecoins connect to airdrops, DEXs, and even NFTs—because they’re not just a tool. They’re the invisible thread holding much of today’s crypto economy together. Whether you’re new or have been trading for years, understanding stablecoins means understanding where the real value flows—and where the risks hide.

Cross-Border Payments with Blockchain Technology: Faster, Cheaper, and Transparent

Blockchain is transforming cross-border payments by slashing fees, cutting settlement time to minutes, and offering full transparency. Learn how stablecoins, CBDCs, and platforms like Ripple and Stellar are making international money transfers faster and cheaper than ever.

Stablecoins: How They Solve Crypto Volatility

Stablecoins solve crypto's biggest problem-volatility-by pegging their value to stable assets like the U.S. dollar. They enable fast, low-cost digital payments and are becoming essential for global finance.