Web3 Security: Protect Your Crypto Assets from Scams, Hacks, and Loss

When you use Web3 security, the practices and tools that protect your digital assets on decentralized networks. Also known as blockchain security, it’s not optional—it’s the difference between keeping your crypto and losing it all to a single click. Unlike banks, there’s no customer service to call if you send funds to the wrong address or approve a malicious smart contract. Once it’s gone, it’s gone forever.

Crypto scams, fraudulent schemes designed to trick users into giving up their private keys or signing harmful transactions are everywhere. Fake airdrops like the ones mentioned in posts about BSC AMP, a token that doesn’t exist but has fake airdrop scams tied to it, or phishing sites pretending to be EO.Trade or ApertureSwap, are designed to look real. People lose money because they trust logos, not verification. If a site asks for your seed phrase, it’s already a scam. No legitimate platform ever will.

Wallet security, how you store and manage your private keys and access to blockchain assets is the first line of defense. Using MetaMask? Make sure you’re on the official site. Enable hardware wallets for large holdings. Never reuse passwords. Turn off public transaction visibility where possible. Many of the posts here—like the ones about Horizon Dex or ko.one—show what happens when people ignore these basics. They didn’t get hacked by a genius coder. They clicked a link that looked like a real exchange.

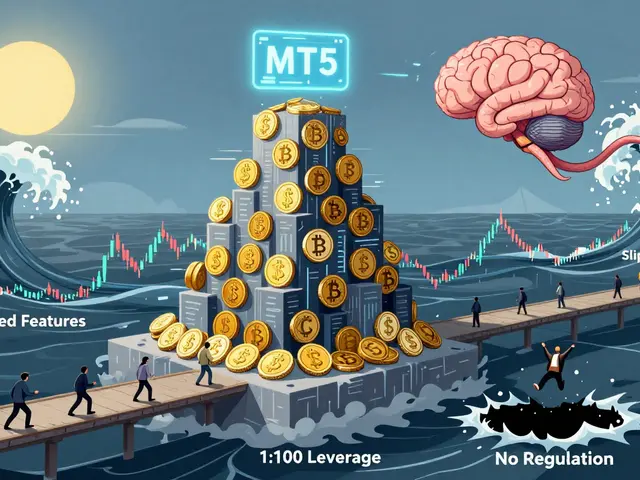

Web3 security isn’t about being paranoid. It’s about being aware. The Byzantine Generals Problem explains why blockchains need trustless systems—but it doesn’t protect you from your own mistakes. A stop-loss for Bitcoin helps manage risk, but it won’t stop you from approving a malicious contract. A fan token like ATM lets you vote on jersey designs, but it won’t warn you if the website you’re using is fake. The same tools that make DeFi powerful—smart contracts, decentralized exchanges, no-KYC platforms—are the same ones hackers exploit.

Real users lost money because they thought "no KYC" meant "no risk." They didn’t check if Coinzo had a license. They didn’t research if Metahero’s airdrop was still active. They trusted hype, not verification. And now, $150 million in crypto assets are frozen in the Philippines because regulators shut down unlicensed platforms. That’s not a failure of blockchain—it’s a failure of user caution.

Below, you’ll find real stories of what went wrong: fake tokens, broken exchanges, hidden scams, and how people lost everything. You’ll also see how to spot the red flags before it’s too late. This isn’t theory. These are the mistakes real people made—and how you can avoid them.

How Social Engineering Powers Cryptocurrency Scams and How to Avoid Them

Social engineering is the leading cause of cryptocurrency losses, using psychology, not code, to trick people into giving up their funds. Learn how scams like pig butchering, deepfakes, and fake support work-and how to stop them.