Russia Bitcoin Cashout Calculator

How This Works

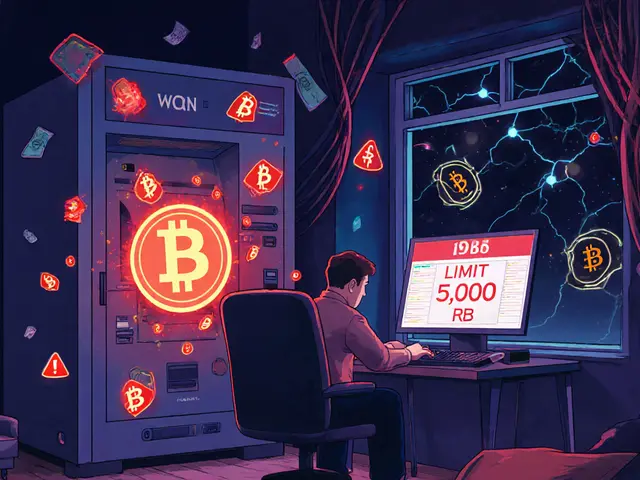

Russia's Central Bank limits daily ATM withdrawals to 50,000 rubles ($600) after suspicious activity. This tool calculates how many transactions you'll need to convert your Bitcoin to rubles while staying under the limit.

Warning: Russian banks monitor all transactions. Transactions exceeding 200,000 rubles between accounts or using QR codes will trigger alerts. Your account could be restricted for 48 hours.

Input Your Details

On September 1, 2025, Russia didn’t ban Bitcoin. But it made it nearly impossible to turn Bitcoin into cash without raising red flags. The Central Bank of Russia rolled out a new rule: if your ATM withdrawals look unusual, your daily limit drops to 50,000 rubles-about $600-for 48 hours. That’s not a cap on how much you can spend. It’s a trap for anyone trying to cash out crypto earnings.

Why? Because banks are now watching everything. A withdrawal within 24 hours of getting a loan? Suspicious. A new phone number linked to your account? Flagged. Transferring more than 200,000 rubles between your own accounts? Triggered. Even using a QR code to pay for something or switching your mobile banking PIN can set off alarms. The goal was to stop fraud, but it hit crypto traders hardest. In the second quarter of 2025 alone, Russian banks reported over 273,000 fraud cases totaling 6.3 billion rubles. The crackdown wasn’t just about theft-it was about control.

How Russia’s Crypto Rules Actually Work

Russia doesn’t say you can’t own Bitcoin. You can buy it on Binance, Kraken, or any foreign platform. You can hold it in a wallet. You can even send it to someone in Turkey or Kazakhstan. But if you try to turn it into rubles through a local exchange, you hit a wall. There are no licensed Russian crypto exchanges for retail users. The only legal path is through an experimental program for qualified investors-people with over 100 million rubles in assets and annual incomes above 50 million. That’s less than 0.01% of the population.

For everyone else, crypto trading has always happened in the gray zone: peer-to-peer (P2P) platforms, small exchange kiosks, cash deals in parking lots or cafes. These were the backbone of Russia’s crypto economy. Now, with daily cash withdrawal limits and real-time bank monitoring, those methods are collapsing. A miner in Novosibirsk who used to sell 5 BTC a month for cash now has to spread it across 100 separate transactions-each under 50,000 rubles. That’s not practical. It’s not safe. And it’s not profitable.

Workarounds: What People Are Doing Now

People aren’t giving up. They’re adapting.

- Foreign P2P platforms like Paxful and LocalBitcoins are seeing a surge in Russian users. Traders use VPNs to bypass geo-blocks and find buyers in Armenia, Georgia, or Kazakhstan who pay via bank transfer or crypto. No cash. No ATM. No flags.

- Virtual cards from non-Russian providers (like Payoneer or Revolut) are being loaded with crypto proceeds. Users then spend those funds online or withdraw from ATMs abroad-where Russian monitoring doesn’t reach.

- Gift cards and digital goods are becoming a bridge. Traders sell Bitcoin for Amazon.ru gift cards, Steam wallets, or even Xbox credits. These can be resold in local markets or traded for rubles through underground networks.

- Barter trading is growing. A crypto holder might trade 0.5 BTC for a used car, a laptop, or even a month’s rent. No bank involved. No paper trail. Just direct value exchange.

One trader in Yekaterinburg told me he now buys bulk electronics from China using Bitcoin, then sells them locally for cash. It’s slow, but it works. He doesn’t touch ATMs anymore.

Miners Are in Crisis

Russia used to be one of the top five crypto mining countries. That changed in January 2025, when 10 out of 46 regions banned mining operations over energy use concerns. But mining didn’t disappear-it just got quieter. Many miners moved to Siberia or the Far East, where enforcement is weaker.

The real problem? Cash-out. Miners used to sell their Bitcoin directly to local buyers for rubles. Now, with withdrawal limits, they can’t liquidate. Some are turning to foreign mining pools that pay in stablecoins. Others are partnering with traders who use the gift card workaround. A few have even started offering mining-as-a-service-letting people pay in crypto to rent hash power, then splitting profits in Bitcoin.

According to Vyacheslav Kopylov of Prostomining, mining revenue in Russia is still growing. But the income isn’t flowing back into the ruble economy. It’s leaking out.

Alternatives: What’s Coming Next

The government isn’t blind to the chaos. In August 2025, a group of lawmakers pushed the Central Bank to license domestic crypto exchanges. They argued that if people are going to trade anyway, it’s better to regulate it than let it go dark.

One idea gaining traction? A state-backed crypto bank. Think of it like Belarus’s model: a bank that accepts crypto deposits, lets you trade Bitcoin on its platform, and converts it to rubles under strict oversight. The benefits? It could bring billions in tax revenue, reduce underground activity, and give miners a legal way to cash out. But the Central Bank still resists. They fear losing control.

Meanwhile, the finance ministry is quietly suggesting loosening rules for international crypto use. Russia still wants Bitcoin for trade with Iran, India, and China-especially to bypass Western sanctions. But domestically? They want it locked down.

What This Means for the Average User

If you’re just holding Bitcoin in Russia right now, you’re not in immediate danger. But if you need to spend it, you’re stuck. The old ways are gone. The legal ways are out of reach. That leaves you with three choices:

- Use foreign platforms with a VPN and stablecoins

- Trade in physical goods or services

- Wait for a licensed exchange to launch-possibly in 2026

There’s no perfect solution. But there are paths. The key is avoiding cash. The moment you walk into an ATM to pull out 100,000 rubles after selling Bitcoin, you’re playing Russian roulette with your account.

The Bigger Picture

Russia’s crypto ban isn’t about stopping Bitcoin. It’s about stopping the loss of financial control. The state doesn’t want its citizens bypassing the banking system. It doesn’t want capital fleeing. And it definitely doesn’t want criminals using crypto to launder money.

But the result? Russia dropped from 7th to outside the top 10 in global crypto adoption in 2025, according to Chainalysis. Neighboring Ukraine, under war conditions, also fell. The message is clear: when governments try to block crypto with brute force, people find smarter ways around it.

Russia’s experiment may succeed in reducing fraud. But it’s also pushing innovation underground-and out of the country. The next generation of Russian crypto entrepreneurs won’t be building exchanges in Moscow. They’ll be building them in Dubai, Tbilisi, or Berlin.

Angel RYAN

November 29, 2025 AT 10:04They’re not breaking the law-they’re outsmarting it.

SHASHI SHEKHAR

December 1, 2025 AT 06:09Also, if you’re still using ATMs to cash out crypto in Russia, you’re doing it wrong. Like, really wrong. 😅

Vaibhav Jaiswal

December 1, 2025 AT 12:27Miners are the unsung heroes here. No medals, no press, just hash power and hustle.

Abby cant tell ya

December 1, 2025 AT 18:13Janice Jose

December 2, 2025 AT 14:16