50x.com Leverage: What It Is, How It Works, and Why You Should Be Careful

When you see 50x.com leverage, a high-leverage trading platform offering up to 50x exposure on crypto assets. Also known as 50x margin trading, it lets you control a position 50 times larger than your actual deposit. But this isn’t free money—it’s a double-edged sword that can turn a small win into a big profit or erase your balance in seconds. Most beginners think leverage is a shortcut to riches. It’s not. It’s a tool used by professionals who understand risk, timing, and market depth—exactly the kind of things you’ll see covered in posts about market depth, how buying and selling pressure builds at different price levels in crypto markets and unregulated crypto exchanges, platforms without oversight that often lack proper risk controls.

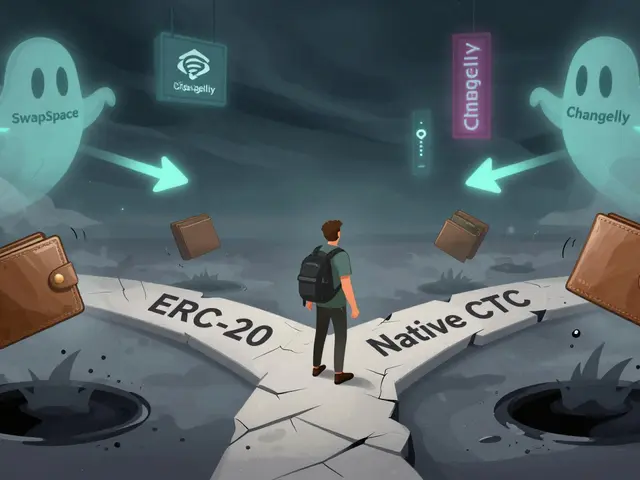

Platforms like 50x.com don’t exist in a vacuum. They’re part of a larger ecosystem where traders use margin trading, borrowing funds to amplify position size to chase quick gains. But without proper risk management, it’s like driving a sports car with no brakes. You’ll see this in posts about exchanges like Horizon Dex and ko.one—platforms with no transparency, no audits, and no safety nets. If a platform offers 50x leverage but won’t tell you how it protects your funds, that’s a red flag. Real exchanges like Binance or Coinbase offer lower leverage (often 10x or 20x max) because they know most people can’t handle 50x. The ones that don’t? They’re gambling with your money.

High leverage doesn’t just hurt you—it makes the whole market more unstable. When thousands of traders use 50x on the same coin, a tiny price drop triggers cascading liquidations. That’s why you’ll find posts about frozen assets in the Philippines and crackdowns on no-KYC exchanges. Regulators aren’t just targeting fraud—they’re trying to stop systems where one bad trade can collapse hundreds of accounts. And if you’re thinking about using 50x.com leverage, ask yourself: Do you really understand how liquidation works? Have you tested your strategy in a live market with real volatility? Or are you just hoping for a lucky swing? The posts below show real cases—people who lost everything chasing leverage, platforms that vanished overnight, and the few who survived by treating leverage like a scalpel, not a sledgehammer. What you’ll find here isn’t hype. It’s hard truths from the front lines of crypto trading.

50x.com Crypto Exchange Review: High Leverage, Unverified Claims, and Real User Risks

50x.com claims high leverage and 10,000+ coins, but lacks verification, audits, and user reviews. Find out why this exchange is risky despite its bold promises.