Crypto Workarounds 2025: How People Bypass Restrictions and Trade Smarter

When governments block access to banks or ban crypto trading outright, people still find ways to use crypto workarounds, practical methods people use to access and trade cryptocurrency despite legal or financial barriers. Also known as crypto evasion tactics, these aren’t just tech hacks—they’re survival strategies for millions. From students in India using stablecoins to pay for college fees, to families in Cuba sending remittances through Bitcoin, crypto workarounds are no longer niche—they’re mainstream.

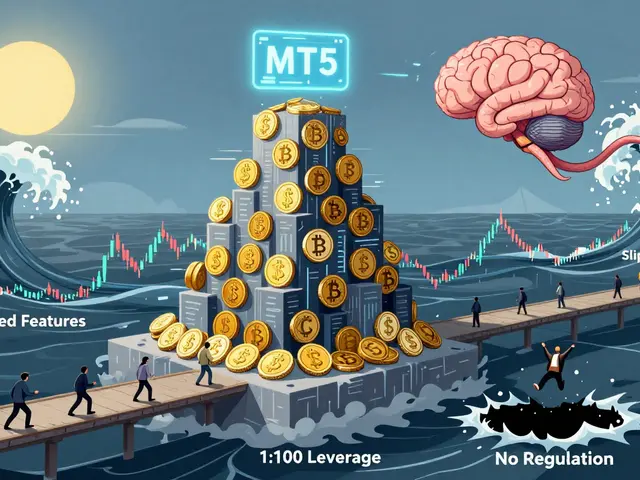

These workarounds rely on three key tools: no-KYC crypto exchanges, platforms that let users trade without identity verification, often operating in legal gray zones, peer-to-peer (P2P) trading, direct person-to-person crypto transactions that bypass traditional financial gatekeepers, and crypto airdrops, free token distributions that reward users for simple actions, often used to bootstrap new projects or bypass funding restrictions. But not all workarounds are safe. Many airdrops in 2025 are scams pretending to be from CoinMarketCap or popular platforms. Some exchanges, like Horizon Dex or ko.one, have no real infrastructure—just fake websites asking for wallet access. Meanwhile, places like Bangladesh and North Macedonia have underground crypto markets thriving despite official bans, proving that regulation doesn’t stop demand—it just pushes it underground.

What you’ll find here isn’t theory. It’s real cases: how Cubans use crypto to buy groceries under U.S. sanctions, how Indians bypass heavy taxes with decentralized swaps, and why a 12-year prison sentence for crypto trading in Bangladesh is mostly a myth. You’ll see which airdrops are real—like the GEMS NFT giveaway tied to an active esports platform—and which are pure scams, like VDV VIRVIA or AFEN Marketplace. You’ll learn how to spot fake tokens, avoid frozen assets like those seized in the Philippines, and understand why even legitimate tools like decentralized exchanges require caution. This isn’t about breaking rules. It’s about understanding how real people navigate broken systems—and what you can learn from them to trade smarter, safer, and more effectively in 2025.

Russia's Crypto Banking Ban: How Traders Are Bypassing Bitcoin Restrictions in 2025

Russia's 2025 crypto cash withdrawal limits have crippled local Bitcoin trading. Traders are turning to foreign platforms, gift cards, and barter systems to bypass ATM restrictions and keep crypto flowing.