Mint Crypto: What It Really Means and How It Works

When you hear mint crypto, the process of creating new cryptocurrency tokens on a blockchain. Also known as token generation, it's not magic—it's code running on a network that decides who gets what and when. Most people think minting means getting free money, but it’s really about control: who writes the rules, who verifies the supply, and whether the token has any real use after it’s created.

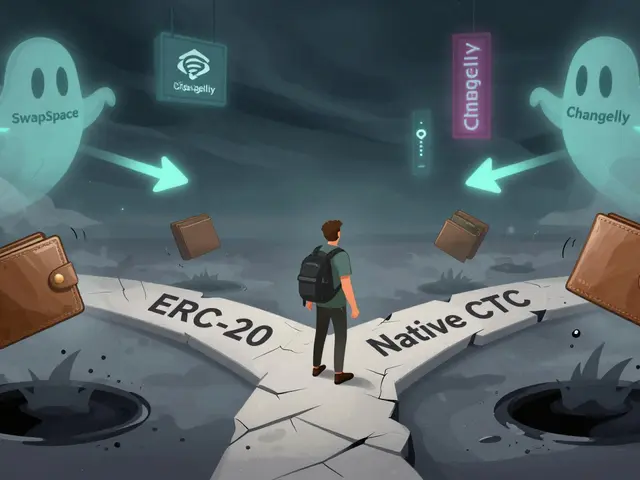

People often confuse minting with crypto airdrop, a distribution method where tokens are given out for free to attract users or reward early adopters. Also known as token giveaway, it’s a marketing tactic, not a creation event. Airdrops don’t mint tokens—they just hand out tokens that were already minted. You’ll see this over and over in the posts below: projects like MultiPad, Flux Protocol, and GEMS NFTs ran airdrops, but the tokens were created weeks or months earlier. The real minting happened when the smart contract was deployed and the total supply was locked in.

Then there’s token distribution, how those newly minted tokens are allocated among founders, investors, and the public. Also known as tokenomics, it’s the hidden engine behind every coin’s value—or lack of it. Look at projects like Apertum or SakeToken: one has deflationary mechanics and community governance, the other has no team and $150K in market cap. The difference isn’t the minting date—it’s the distribution plan. If 80% of tokens go to insiders, you’re not investing—you’re buying the leftovers.

And then there’s the truth no one tells you: most tokens you see being "minted" today are fake. The VDV VIRVIA airdrop? A scam. The AFEN Marketplace token? Doesn’t exist. The BSC AMP airdrop? Zero liquidity, zero team. These aren’t mistakes—they’re designed to look like real crypto projects so you’ll connect your wallet and lose your funds. Minting crypto sounds technical, but in practice, it’s often just a front for stealing money.

What you’ll find here aren’t guides on how to mint your own token. That’s for developers with code skills and a deep understanding of Ethereum or Binance Smart Chain. What you’ll find are real stories: how Cubans use crypto to survive, how India bypasses tax rules, how the Philippines froze $150 million in unlicensed tokens, and why you should never trust a free token offer that asks for your private key. These aren’t theory pieces—they’re warnings from people who lost money, and others who learned how to avoid it.

If you’re wondering whether minting crypto is worth your time, the answer isn’t in the code. It’s in the people behind it. Who’s holding the keys? Who’s auditing the contract? Who’s actually using the token? The posts below cut through the noise. No fluff. No hype. Just what’s real, what’s fake, and what you need to know before you click "mint" or "claim" on anything.

MintMe.com Crypto Exchange Review: Can You Really Mint and Trade Tokens Easily?

MintMe.com lets you create and trade custom crypto tokens with no coding. It's easy for creators and meme coin lovers, but lacks security, support, and regulation. Know the risks before you mint.