Bitcoin Stop-Loss Calculator

Input Parameters

How This Works

Proper stop-loss placement keeps you in the game. This calculator helps you:

- 1 Calculate position size based on risk percentage

- 2 Determine risk exposure in dollar amount

- 3 Identify potential slippage based on volatility

Results

Risk Amount: $0.00

Position Size: 0.00 BTC

Stop-Loss Distance: 0.00%

Bitcoin doesn’t care if you’re sleeping, on vacation, or watching a movie. One minute it’s at $62,000, the next it’s down to $58,000 - and you didn’t even see it coming. That’s why setting a stop-loss for Bitcoin isn’t optional. It’s the difference between keeping your capital and losing it in a flash.

What a Stop-Loss Actually Does for Bitcoin

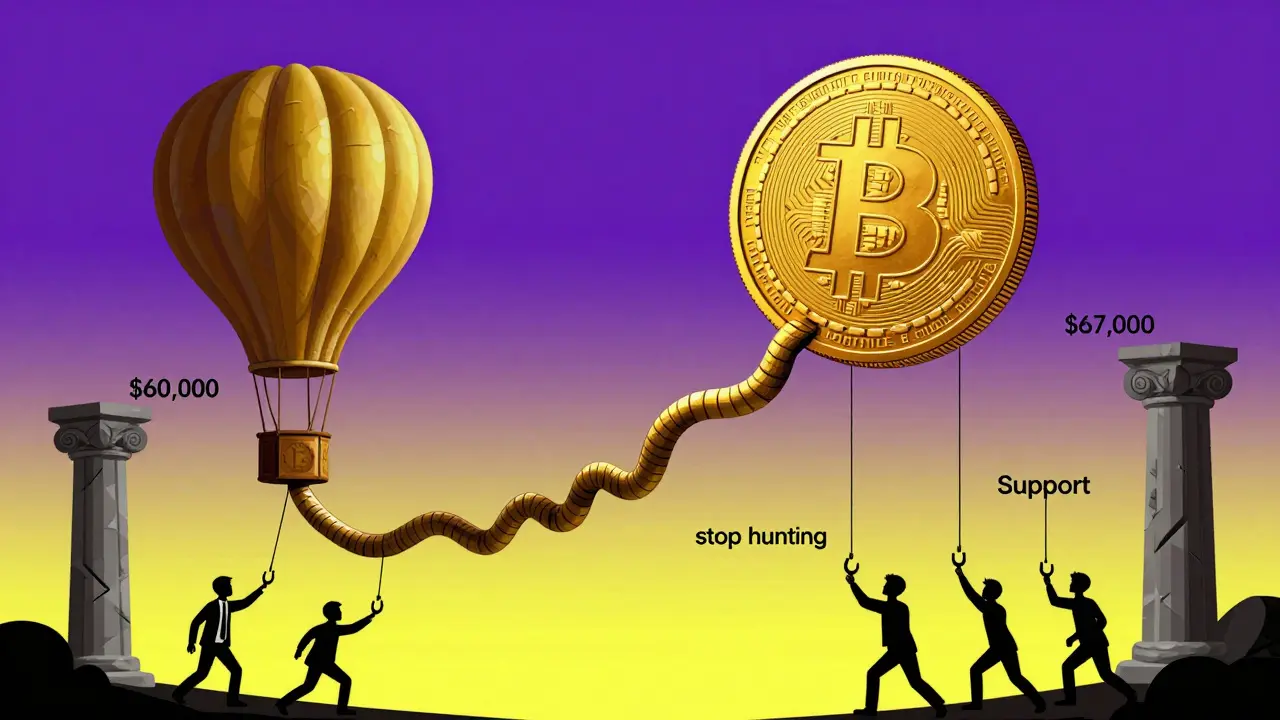

A stop-loss order is an automated instruction to sell your Bitcoin when the price hits a level you set. It’s like a safety net that kicks in when things go south. You don’t have to stare at your screen 24/7. You don’t have to panic when the market drops. You just set it, walk away, and let the system handle it. Most major exchanges - Binance, Gemini, Bitstamp - offer this feature. It’s not magic. It’s just code. When Bitcoin’s price hits your stop level, the exchange turns your stop-loss into a market order and sells your coins at the next available price. But here’s the catch: that next price isn’t always what you expect. During big drops, especially in crypto, prices can gap. You set a stop at $58,000, but the market crashes so fast that your Bitcoin sells at $56,200. That’s called slippage. It’s normal in Bitcoin. You can’t avoid it completely. But you can reduce it.Where to Set Your Stop-Loss: Not Just Any Number

Don’t just pick a number because it feels right. That’s how beginners lose money. A stop-loss should be based on market structure, not emotion. Look at Bitcoin’s price history. Where has it bounced back before? Those are support levels. If Bitcoin has held above $57,000 three times in the last month, that’s a strong support zone. Your stop-loss should go just below it - say, $56,800. That gives the market room to wiggle without triggering your order. If you set your stop at $57,000, you’re putting it right where hundreds of other traders are watching. That’s a magnet for manipulation. Big players know where the crowd’s stops are. They’ll push the price down just enough to trigger them, then bounce back up. You get sold out. They buy the dip. You lose. They win. Use tools like TradingView to mark support levels. Look at daily and 4-hour charts. Don’t rely on 15-minute charts - they’re too noisy. Your stop-loss should survive normal volatility, not get triggered by every ripple.How Much Risk Are You Really Willing to Take?

Here’s the rule every pro follows: never risk more than 1-2% of your total trading balance on one trade. Let’s say you have $10,000 in your Bitcoin trading account. You want to buy 0.1 BTC at $60,000. That’s $6,000 invested. If you set your stop-loss at $57,000, you’re risking $3,000 per coin - $300 total. That’s 3% of your account. Too much. Instead, buy 0.05 BTC ($3,000). Set your stop at $57,000. Now you’re risking $150. That’s 1.5% of your account. Perfect. This is called position sizing. It’s not about how much Bitcoin you want. It’s about how much you can afford to lose. Your stop-loss placement should be calculated from this number, not the other way around.

Trailing Stop-Loss: Let Bitcoin Run, But Protect Your Gains

A regular stop-loss is static. A trailing stop-loss moves with the price. Say you bought Bitcoin at $60,000 and set a 5% trailing stop. When Bitcoin hits $63,000, your stop moves up to $59,850. When it hits $67,000, your stop moves to $63,650. You’re locking in profits as the price rises. If Bitcoin then drops to $63,500, your order triggers and sells at the next available price. You didn’t catch the top. But you kept most of your gains. Trailing stops are perfect for Bitcoin’s big bull runs. They turn a good trade into a great one without you lifting a finger. Most exchanges let you set trailing stops as a percentage (like 5%) or a fixed dollar amount (like $2,000). Percentage is better for Bitcoin - it scales with volatility.When to Adjust Your Stop-Loss

Your stop-loss isn’t set in stone. You adjust it as the market changes. After a strong upward move: If Bitcoin jumps from $60,000 to $65,000 in a day, move your stop up to break-even or slightly above. You don’t want to give back all your profits. During consolidation: If Bitcoin stalls between $62,000 and $64,000 for days, don’t tighten your stop. Volatility is low. You’re not in danger. Let it breathe. Moving your stop too close now just invites a fakeout. Before big events: Fed announcements, ETF decisions, or Bitcoin halvings can cause wild swings. If you expect volatility, widen your stop-loss - maybe to 8-10% below your entry. Tightening it might get you stopped out before the real move starts. You’re not trying to time the market. You’re protecting your position so you can ride the trend.Stop-Loss vs. Stop-Limit: Which One Should You Use?

There are two types of stop orders:- Stop-loss (market): Triggers and sells immediately at the next price. Faster execution, but risk of slippage.

- Stop-limit: Triggers and becomes a limit order. You set a limit price - say, $57,000. The order only executes if someone buys at $57,000 or better. No slippage, but risk of not filling at all.

Common Mistakes (And How to Avoid Them)

- Setting stops too tight: 2-3% stops get triggered by normal noise. Bitcoin swings 5-10% daily. Use 5-8% as a starting point.

- Placing stops at round numbers: $60,000, $55,000 - these are obvious. Traders pile stops there. Avoid them. Go 1-2% below real support.

- Ignoring volume: If Bitcoin drops through support on low volume, it might be a fakeout. Wait for confirmation before adjusting your stop.

- Forgetting to check your order: Exchanges can glitch. Orders can get canceled. Double-check your stop-loss after placing it.

What Works for Pros

Top Bitcoin traders don’t just guess. They use tools:- Average True Range (ATR): This measures volatility. If Bitcoin’s 14-day ATR is $4,000, set your stop 1.5x that - $6,000 below entry. It adapts to market conditions.

- Multiple stops: Sell 50% at a 5% stop, 30% at 8%, and 20% at 12%. You reduce risk gradually. You don’t bail all at once.

- Time-based stops: If your trade hasn’t moved in 3 days, cancel it. Bitcoin doesn’t wait forever.

Final Thought: Stop-Loss Is Discipline, Not Luck

Bitcoin trading isn’t about predicting the future. It’s about managing risk when the future surprises you. A stop-loss doesn’t make you a better trader. But it keeps you alive long enough to become one. Set it based on support. Size your position to risk 1-2%. Use trailing stops in trends. Adjust before big news. Avoid round numbers. Check your orders. Do that, and you’re already ahead of 80% of Bitcoin traders.Can you set a stop-loss on decentralized exchanges like Uniswap?

Most decentralized exchanges (DeFi) like Uniswap don’t offer native stop-loss orders. You can use third-party tools like Gnosis Safe or automated bots (e.g., 3Commas, Cryptohopper) to simulate stop-losses, but they rely on off-chain monitoring and aren’t as reliable as centralized exchange orders. For serious Bitcoin trading, stick to platforms like Binance or Coinbase that offer built-in stop-loss functionality.

What happens if Bitcoin crashes overnight and my stop-loss doesn’t trigger?

If your stop-loss is set correctly, it will trigger when the price hits your level - even overnight. Exchanges run 24/7 and execute orders automatically. The only time it might not work is if the exchange has technical issues or if the market gaps so hard that your order fills far below your stop. That’s slippage, not failure. That’s why you use position sizing to limit your total risk.

Should I use a stop-loss if I’m holding Bitcoin long-term?

If you’re a long-term holder (HODLer), you don’t need a stop-loss. You’re betting on Bitcoin’s value over years, not days. Stop-losses are for traders who actively buy and sell. But if you’re using dollar-cost averaging or trading part of your Bitcoin holdings, then yes - use stop-losses on those active positions.

Is a 5% stop-loss too wide for Bitcoin?

Not at all. Bitcoin regularly swings 5-10% in a single day. A 5% stop-loss is actually conservative for short-term trading. Many beginners use 2-3% stops and get shaken out by normal volatility. A 5-8% stop gives you room to breathe while still protecting your capital.

Can stop-loss orders be hacked or manipulated?

Stop-loss orders themselves can’t be hacked. But market makers can manipulate price to trigger them - this is called stop hunting. That’s why you avoid obvious levels like $60,000 and place stops just below real support. It’s not about avoiding manipulation entirely - it’s about making it harder and less profitable for others to trigger your orders.

Vincent Cameron

December 7, 2025 AT 01:12Bitcoin doesn't care if you're watching or not. That's the brutal truth. A stop-loss isn't about being smart-it's about being alive in this game. I've seen guys with PhDs lose everything because they thought they could 'feel' the market. Nah. The market feels you. Set your level below real support, not some pretty round number. And never, ever risk more than 2%. Your ego doesn't get a vote in your portfolio.

Trailing stops are the silent killers of FOMO. I let mine ride through 2021's madness and walked away with 7x. Not because I predicted it-because I refused to be greedy. Discipline isn't sexy. But it's the only thing that lasts when the lights go out.

Noriko Robinson

December 7, 2025 AT 01:16I used to set stops at $60k because it felt safe. Then I got stopped out twice in one week while Bitcoin bounced right back. Now I use ATR. It’s not perfect but it’s honest. The market moves in waves, not lines. I check my stops every few days, not every hour. And I never adjust them during a weekend. If you’re watching your chart every 10 minutes, you’re not trading-you’re gambling with caffeine.

Also, avoid round numbers like the plague. $57,300 is way better than $57,000. The bots don’t care about your psychology. They care about liquidity pools. Be the ghost in the machine, not the target.

Mairead Stiùbhart

December 7, 2025 AT 15:15Oh sweet mercy, another post telling me to use a stop-loss like it’s some sacred ritual. Let me guess-you also brush your teeth with Himalayan salt and meditate to Bitcoin whitepapers? Fine. Do it. But don’t pretend this is investing. You’re speculating with a safety harness. Congrats, you’re not the guy who lost everything. You’re the guy who lost 2% and still thinks you’re a genius.

Meanwhile, I’m holding my BTC in a cold wallet and ignoring the noise. Your stop-loss doesn’t make you a trader. It just makes you less likely to cry in public.

Billye Nipper

December 9, 2025 AT 09:14I just want to say-thank you. Seriously. I used to set stops at 3% and get shaken out every time Bitcoin had a 5% dip. I was so frustrated. Then I learned about position sizing. I reduced my position size to match my 1.5% risk limit. Now I sleep. I actually sleep. I used to check my phone every 15 minutes. Now I go for walks. My mental health improved more than my portfolio.

Also, trailing stops are a game-changer. I set mine at 7% and just let it ride. I didn’t sell at the top, but I didn’t give back 80% either. And I didn’t have to stare at a screen for hours. You don’t need to be a robot to trade Bitcoin. You just need to be consistent. And patient. And humble.

One more thing: check your orders. I had one cancel once because I used a bad API key. Took me three days to notice. Don’t be me.

Roseline Stephen

December 10, 2025 AT 19:14Tara Marshall

December 11, 2025 AT 06:51DeFi users: you can’t set native stop-losses on Uniswap. But you can use 3Commas or Shrimpy to automate it. Just remember-they’re not as fast as Binance. There’s latency. You’ll get filled worse than you expect. If you’re serious, move to a centralized exchange. Your portfolio will thank you.

And yes, 5% is fine. Bitcoin moves 10% daily. If your stop triggers on a normal pullback, you’re too tight. Use ATR. It’s not magic. It’s math.