Crypto Exchange: How to Choose, Avoid Scams, and Trade Safely

When you trade crypto, you’re not just buying coins—you’re trusting a crypto exchange, a digital platform where you buy, sell, or swap cryptocurrencies. Also known as cryptocurrency trading platform, it’s the gateway between your wallet and the market. But not all exchanges are built the same. Some are backed by audits, licenses, and years of trust. Others? They vanish overnight, leaving users with empty wallets and no recourse.

That’s why understanding the difference between a decentralized exchange, a peer-to-peer platform that lets you trade without giving up control of your funds and a centralized one matters. On a decentralized exchange like Uniswap, you keep your keys. On a centralized one like Binance or Coinbase, they hold your crypto for you. Each has trade-offs: control vs. convenience. And then there are the no-KYC crypto exchange, platforms that let you trade without verifying your identity—once popular for privacy, now being shut down by regulators in the U.S., EU, and Southeast Asia. Why? Because they became magnets for money laundering. The ones still operating often lack security, audits, or even a real website.

And scams? They’re everywhere. Fake exchanges like ko.one and BITEXBOOK look real until you try to withdraw. Airdrop scams like AFEN Marketplace and VDV VIRVIA trick you into connecting your wallet, then drain it. Even legit platforms like 50x.com and 50x.com make wild claims—10,000 coins, 100x leverage—without proof. You don’t need hype. You need transparency: who runs it? Are there audits? Is there a real support team? Is it listed on CoinMarketCap or CoinGecko with real volume? If the answer’s no, walk away.

Across the world, people are finding ways to trade despite bans. In Bangladesh, traders risk jail time but still use P2P apps. In Cuba, Bitcoin replaces remittances. In Turkey, you can’t pay for coffee with crypto—but you can still trade it. These stories aren’t exceptions. They’re proof that crypto exchange access isn’t about laws—it’s about need. And that’s why knowing how to pick a safe, functional platform isn’t optional. It’s survival.

Below, you’ll find real reviews, scam warnings, and deep dives into how exchanges actually work—whether you’re in India bypassing taxes, North Macedonia trading underground, or just trying not to lose your life savings to a fake site. No fluff. Just what you need to know before you click "Buy".

CtcSwap Crypto Exchange Review: How to Trade Creditcoin (CTC) in 2026

There's no exchange called CtcSwap - it's just a term for swapping Creditcoin (CTC) on platforms like SwapSpace and Changelly. Learn how to trade CTC safely in 2026, avoid network mistakes, and understand the risks.

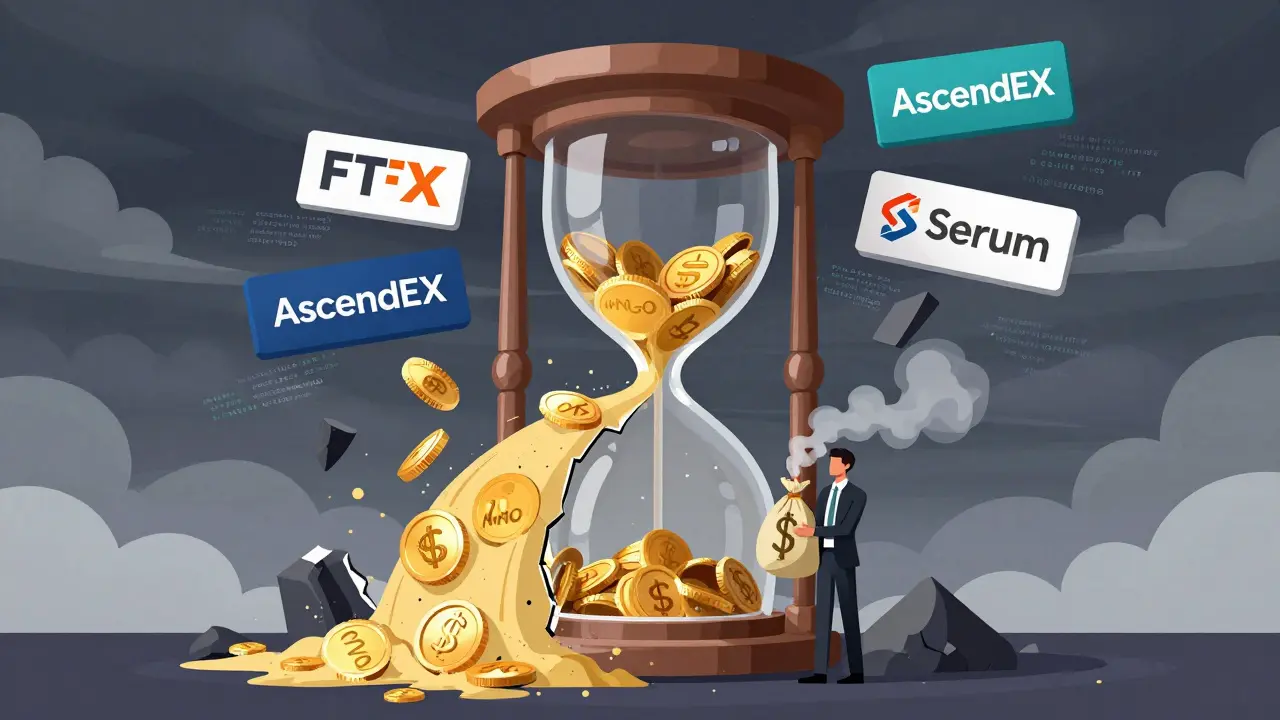

Mango Markets Crypto Exchange Review: What Happened and Why It Shut Down

Mango Markets was a powerful Solana-based DeFi exchange that offered high leverage and low fees-until a $116 million exploit in 2022 and a controversial legal outcome led to its shutdown in January 2025.

Surface Crypto Exchange Review: Best Platforms for Beginners and Traders in 2025

In 2025, the best crypto exchange depends on your needs. Beginners should start with Coinbase or eToro, advanced traders prefer Binance or Kraken, and security-focused users trust Gemini. Fees, regulation, and features vary widely-choose based on how you trade.

PancakeSwap v2 on Linea: Low-Cost DeFi Exchange Review for 2025

PancakeSwap v2 on Linea offers ultra-low gas fees and fast trades for retail crypto users. Learn how it compares to BSC and other DEXs, its pros and cons, and whether it's worth using in 2025.

MintMe.com Crypto Exchange Review: Can You Really Mint and Trade Tokens Easily?

MintMe.com lets you create and trade custom crypto tokens with no coding. It's easy for creators and meme coin lovers, but lacks security, support, and regulation. Know the risks before you mint.

Horizon Dex Crypto Exchange Review: A High-Risk Platform with No Legitimate Presence

Horizon Dex is an unregulated, low-traffic crypto platform with no trading functionality, no user reviews, and no transparency. Avoid it - it's not a legitimate exchange and poses serious risk to your funds.